You may not yet see it on your local grocery store shelves, but the people of China are already experiencing high inflation rates across the board.

In food markets around Shanghai, the price of meat and vegetables has risen by at least 50pc in the past year, sparking anger among poorer shoppers who spend up to half of their income on food.

In some parts of China, the price of basic foods has doubled and shoppers in the southern city of Shenzhen have even taken to skipping across the border to Hong Kong to buy their daily groceries. On the Chinese internet, the Chinese character “Zhang”, which means “inflate”, has been picked as the word of the year.

Now, a freezing winter is threatening to further push up food prices and global commodities such as copper have already broken through record levels, a combination that spells further inflation.

“If there is a recovery in the West, and global commodity prices continue to rise, that could feed problems in China,” said Li Wei, an economist at Standard Chartered, based in Shanghai. “I would not be surprised to see inflation touching 7pc or 8pc in the first half of the year.”

Source: Telegraph

Recovery, in Mr. Li Wei’s use of the term, can actually be defined as continuing prices rises in commodities and stocks – because in the U.S., that’s what our recovery essentially is. Fundamentally, things are much worse than they were in 2008. Look at employment, federal debt, state debt, mortgage defaults, falling home prices and drops in the revenues of private businesses.

Nothing has gotten better – but the stock market is up, your gas prices are up and soon the food on your local grocery store shelf will cost 10% – 50% more. None of this, of course, will be called inflation because it is not counted in our government’s official CPI numbers. So, while you may be paying $8 for a gallon of milk and $5 for a gallon of gas, Federal Reserve Chairman Ben Bernanke will be talking about the threat of deflation and how further monetary expansion and quantitative easing is necessary to keep the system afloat.

There is no recovery in the traditional sense of the word. In this case, recovery equals inflationary price increases.

The Chinese understand what is happening and realize that a large portion of those rising prices is the result of monetary expansion in the United States, which has led to higher prices in commodities markets globally and large infusions of cash in Chinese asset markets. All that money that has supposedly been sitting in bank vaults not being lent to Americans is actually making its way into equities and commodities – hence the perception of “recovery.”

But this won’t last long, not without a serious economic breakdown somewhere:

At stake is the future of the global economy, according to Andy Xie, the former China economist at Morgan Stanley. Writing in Caixin, a Chinese magazine, he said that the two most likely candidates to trigger the next financial crisis are either the US’s sovereign debt or China’s inflation.

“You can describe the global economy as a race between the US and China to see who goes down first,”

Economic Assassin weighs in on the discussion in China Must Kill the Dollar:

China are now acting as their own worst enemy by playing along with demands of the U.S, all China need to do to resolve their current inflationary problems and stop them becoming any worse, they must un-peg the Yuan from the U.S Dollar and allow their currency to appreciate, there are only positive implications for China; They’re currency will appreciate and they will experience a temporary deflationary period which, combined with the rise in purchasing power of the Yuan, will allow the Chinese people to consume more.

The only loser will be the U.S, as there last remaining lifeline, remove themselves, I have no doubt that the Federal Reserve will do nothing but flick the printing press switch to the ‘on’ position.

China has already ‘de-pegged’ the dollar, though appreciation of their currency has been slow. With the onset of high inflation, however, that may change soon. In 2009, Peter Schiff warned that When China Pulls the Peg, Cardiac Arrest Will Follow in the USA:

While the peg certainly is responsible for much of the world’s problems, its abandonment would cause severe hardship in the United States. In fact, for the U.S., de-pegging would cause the economic equivalent of cardiac arrest. Our economy is currently on life support provided by an endless flow of debt financing from China.

How long can China go on funding our never ending need for borrowed money, and when will they finally stop? That is the question. Whether or not China pulls the plug is hard to predict, but all signs point to an eventual cancellation of our ChinEx Visa and significant depegging of the yuan from the dollar.

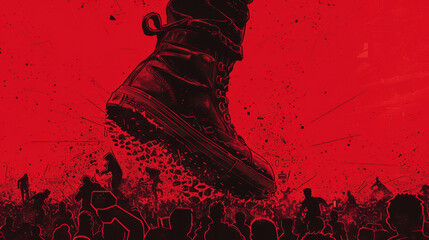

Inflation, double digit inflation and the likelihood of hyperinflation (and thus, economic collapse) may be in our very near future.

Zhang.

0 Comments