This article was originally published by Tyler Durden at ZeroHedge.

UK Maritime Trade Operations warned of a “suspicious activity” on Tuesday morning at the Strait of Hormuz, the world’s most critical energy chokepoint, after numerous small armed boats attempted to stop a U.S. oil tanker.

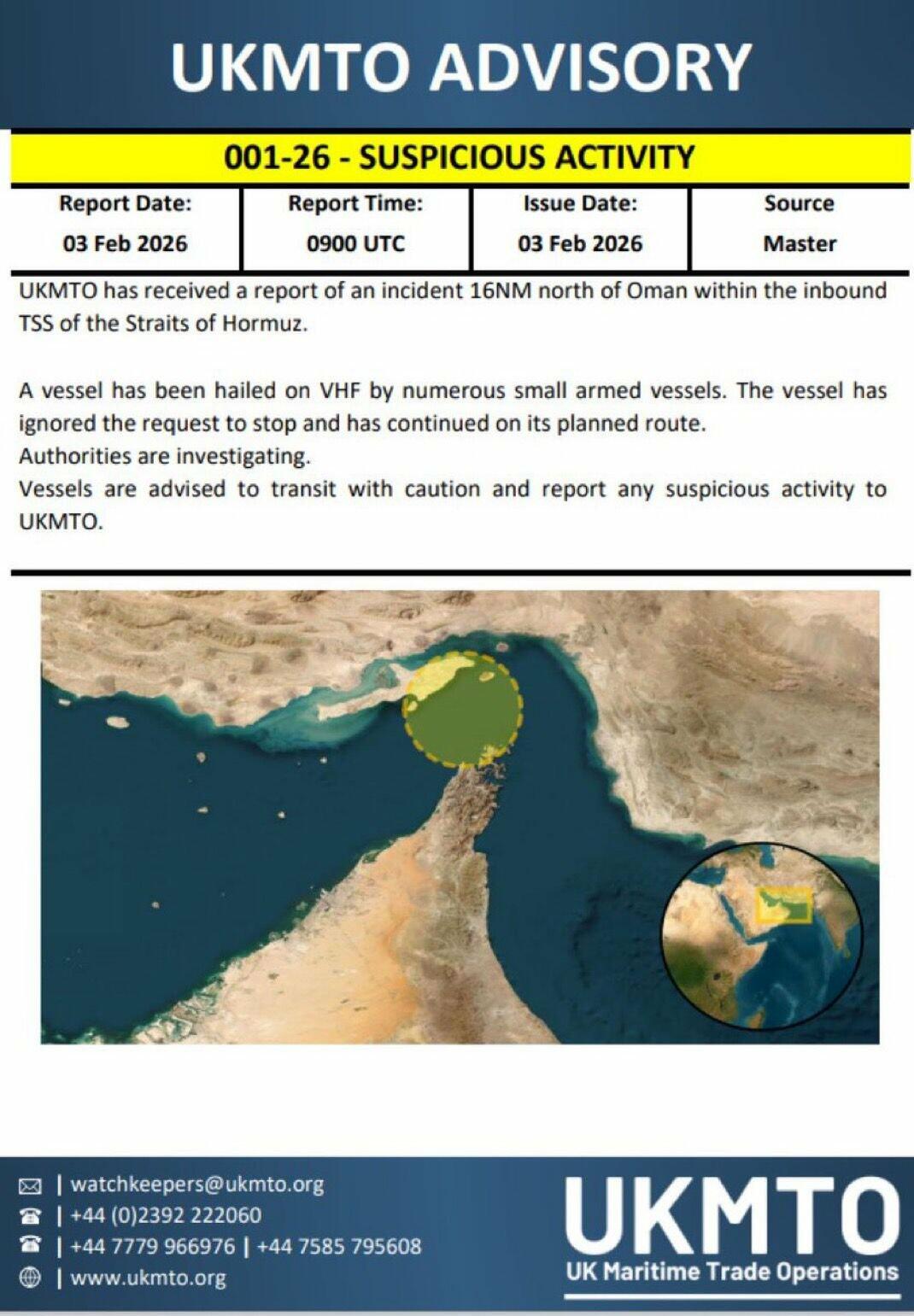

This is what UKMTO has reported so far:

- Location: about 16 nautical miles north of Oman, within the inbound traffic separation scheme

- Incident: a merchant vessel was hailed on VHF by multiple small armed boats

- Response: the vessel ignored requests to stop and continued on its planned route

- Status: authorities are investigating

- Guidance: all vessels are advised to transit with caution and report any suspicious activity to UKMTO

Here’s the UKMTO Advisory:

The Wall Street Journal provided more color on the situation, including the U.S. tanker:

Maritime-security firm Vanguard Tech said in a message to clients that six Iranian gunboats armed with 50-caliber guns approached the tanker as it entered the strategic waterway and ordered it to kill the engines and prepare to be boarded. Instead, the vessel sped up and was later escorted by a U.S. warship.

U.S. officials confirmed armed Iranian boats tried to stop a U.S.-flagged ship and that it was escorted to safety.

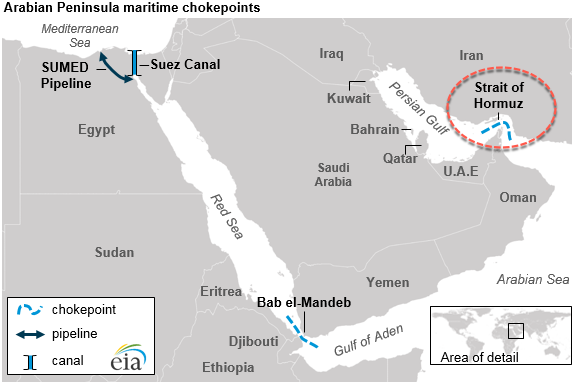

The incident occurred at the critical maritime chokepoint where 20% of oil trade and a large share of LNG flows pass daily.

At its narrowest, shipping lanes are only about 2 miles wide in each direction…

Brent crude prices are marginally higher on the session, trading around $66/bbl handle.

UBS analyst Dominic Ellis provided clients with his assessment of the crude oil market early Tuesday: “The Lowdown: Oil At Risk Of Near-Term Pullback But Risks Remain.”

Ellis continued:

In the near term, UBS strategists are expecting a pullback in oil, which is running ahead of their assumptions for the quarter and the year. They see the market as oversupplied this quarter and in the full year, which should pull Brent back down into the low $60s. It is now in the mid $60s having touched low $70s very recently.

What is challenging their view is that the U.S. is building up a presence in the Middle East, and there is a perceived risk of direct intervention in Iran, which could impact Iranian supply and potentially if things spill over into the wider region, affect the 20% of global crude flows that pass through the Strait of Hormuz.

Brent crude prices…

US-Iran tensions appear to be simmering down:

This comes as the U.S. has been building up naval forces in the region for a possible strike on Iran.

0 Comments