by Ramon Tomey | Apr 18, 2025 | Emergency Preparedness, Forecasting

This article was originally published by Ramon Tomey at Natural News. Foreclosure filings rose sharply in Q1 2025 – up 11 percent quarterly – with March alone seeing 35,890 filings. This reverses three straight quarters of decline, signaling renewed financial...

by Willow Tohi | Apr 8, 2025 | Emergency Preparedness, Forecasting

This article was originally published by Willow Tohi at Natural News. President Donald Trump has introduced aggressive tariffs, including a universal 10% tax on all imports and additional “reciprocal tariffs” targeting over 60 trade partners, with China...

by Michael Snyder | Apr 7, 2025 | Experts, Emergency Preparedness, Forecasting

This article was originally published by Michael Snyder at The Economic Collapse Blog. We have never seen so much stock market wealth get wiped out in such a short period of time. Unfortunately, many major players on Wall Street who made a ton of money on the way up...

by Mac Slavo | Apr 7, 2025 | Headline News, Emergency Preparedness, Experts, Forecasting

Goldman Sachs, the Wall Street bank, has raised the odds of a downturn in the country’s economy following Donald Trump’s massive tariff hike. The risk of a recession has now risen to 45% on the heels of disastrous tariffs. In a research note titled “US Daily:...

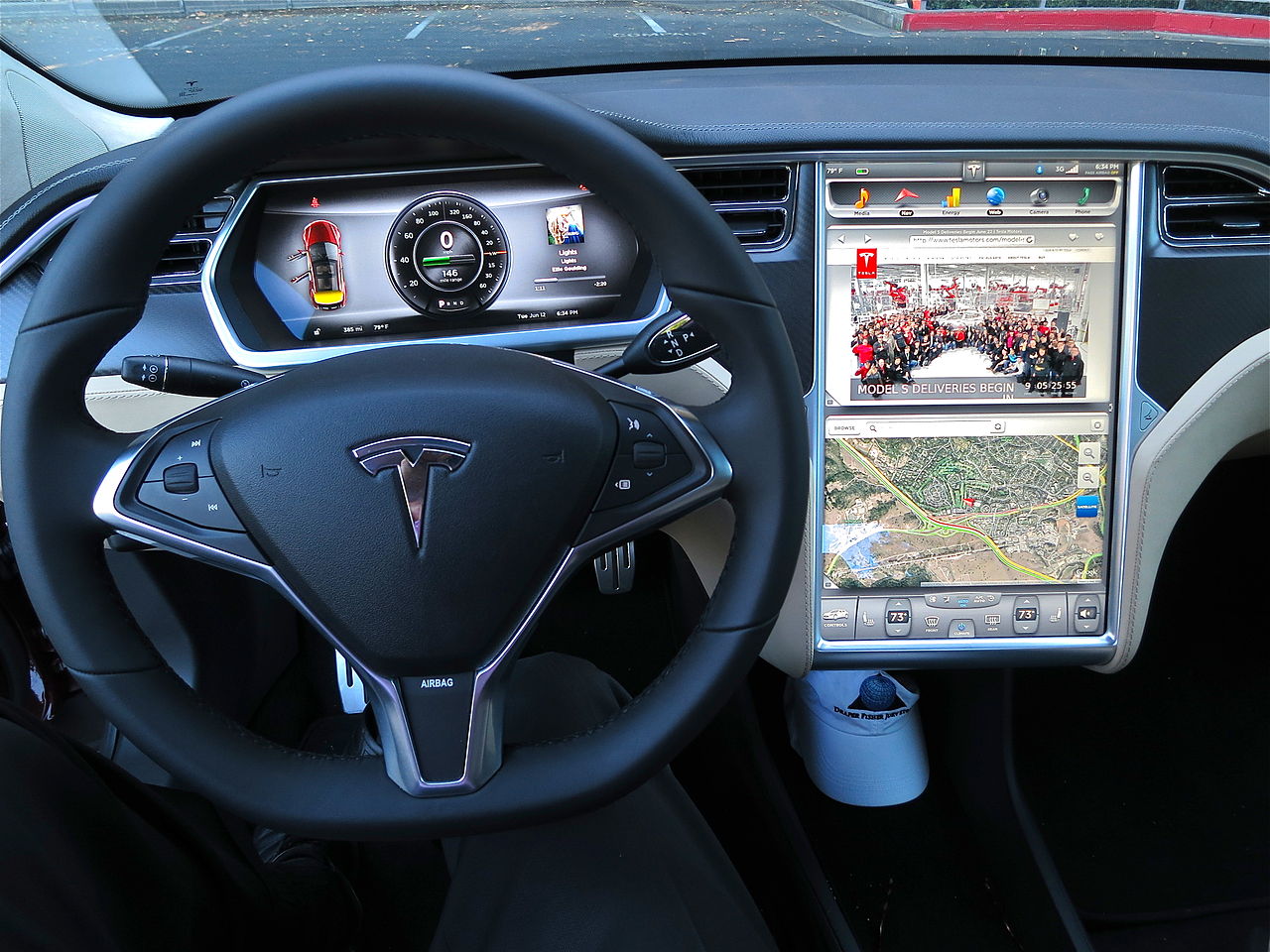

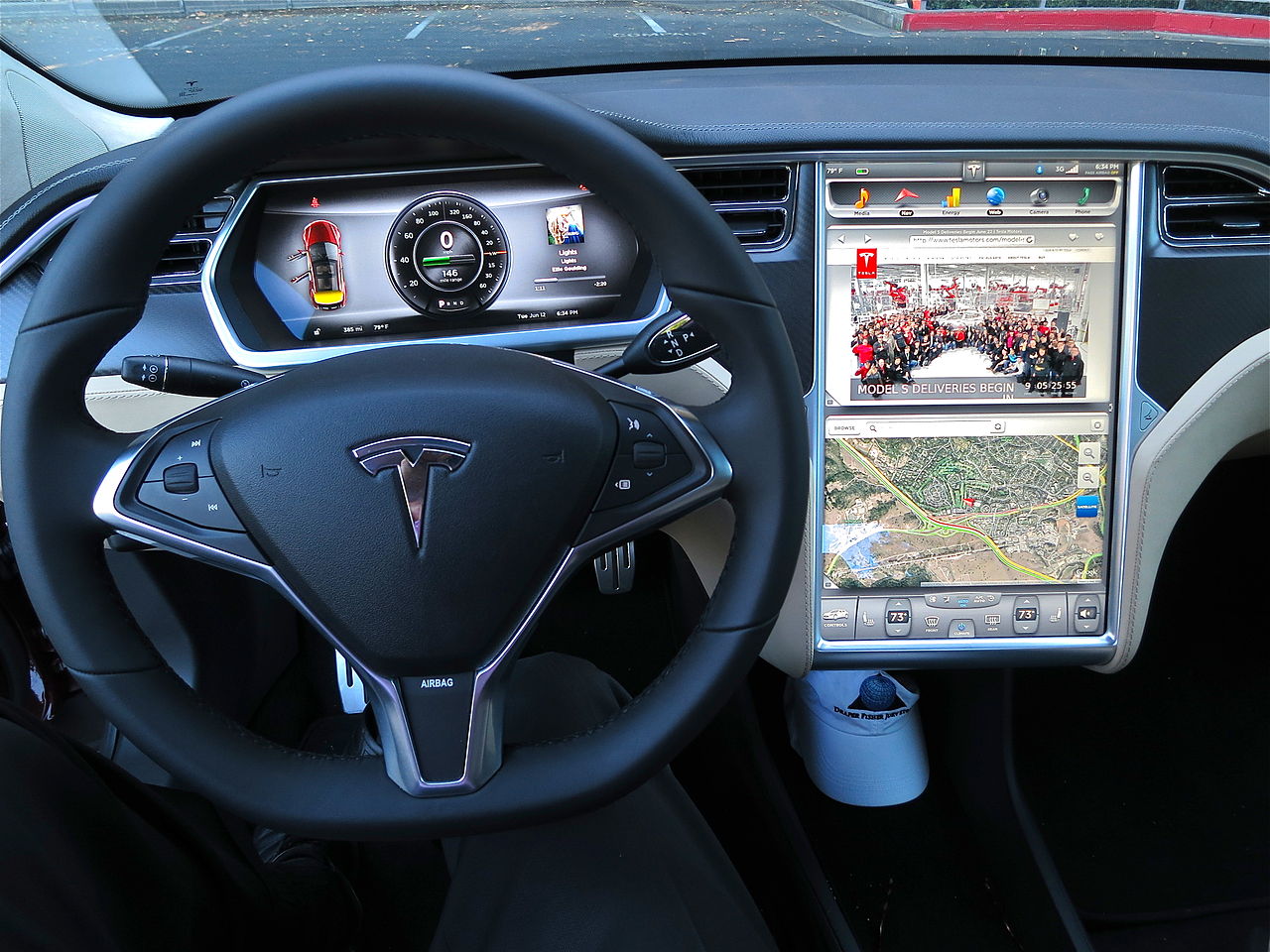

by Tyler Durden | Mar 25, 2025 | Forecasting, Headline News

This article was originally published by Tyler Durden at ZeroHedge. Tesla faces mounting headwinds in Europe, with sales declining for the 10th time over the past 12 months. The slump is driven by an aging vehicle lineup, intensifying competition, and growing...

by Willow Tohi | Feb 25, 2025 | Experts, Forecasting, Headline News

This article was originally published by Willow Tohi at Natural News. The price of gold is experiencing a significant surge, with analysts predicting it could reach $3,000 per ounce in 2025, driven by economic, geopolitical, and market factors. Central banks...