Most retail investors haven’t caught on to this yet, though the smart money is bracing for a strong upswing in the gold cycle. No matter which expert’s prediction turns out to be the right one, the upside for gold and mining stocks will be considerable:

- According to Nicoya Research, their calculations confirm that the previous gold bull cycle propelled the gold price up by roughly 6x. Therefore, the current bull cycle should put the gold price above $6,000 per ounce by the year 2025. Along the way, Nicoya expects gold to reach $3,250 in 2021 and $4,500 in 2022.

- Wells Fargo maintains a projection of gold rising to $2,300 by the end of 2021. Citing low interest rates and an excessive money supply, Wells Fargo head of real asset strategy John LaForge bluntly said, “We’re buyers of gold.”

- With an expectation that the inflation rate will rise to 3% in 2021 – along with “more inflows to gold in order to hedge it” – Goldman Sachs has also set a 12-month gold price forecast of $2,300 per ounce.

- Analysts at Bank of America projected that gold will reach an all-time high of $3,000 by the end of 2021 on the back of record central bank balance sheets and government fiscal deficits.

- Noting that total stimulus, both monetary and fiscal, has now reached $10 trillion, Mr. Frank Holmes is watching for $4,000 gold in 2021. With this projection, Mr. Holmes cites the all-important PMI: “The Purchasing Managers’ Index is a great leading indicator. When that turns for China and when that turns for America, we’re 40% of all global trade, copper, iron, all the metals start surging.”

- Rob McEwen, the Chairman and Chief Owner of McEwen Mining, explains how a perfect storm of contributing factors can lead to gold at $5,000 and beyond: “When you look at the response to fighting Covid, it’s not one country or a small group of countries, it’s global. The monetary expansion has been enormous. In addition, the debt loads are much greater. So I think the possibility of a much higher price than US$5,000 is very real.”

- Pierre Lassonde, Chair Emeritus of Franco-Nevada, is bracing for the gold price to eventually climb to $15,000 to $20,000 per ounce. Mr. Lassonde also notes the advantageous market landscape for resource companies: “The gold miners have never had it so good. The margins they are producing are the fattest, the best, the absolute unbelievable margins they’ve ever had.”

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

Sprott Inc. CEO and metals maven Eric Sprott is preparing for gold to hit $5,000 and then $10,000. “I am a huge believer that metals are manipulated by central authorities when they lose control we could be looking at a sustained gigantic bull market in precious metals,” he explains.

When we’re on the topic of renowned figures in the resource space, we can’t leave out Dr. Quinton Hennigh, the Chairman and President of NOVO Resources Corp. – a major shareholder of New Found Gold, as you’ll recall.

Dr. Hennigh is an economic geologist with 25 years of exploration experience, mainly gold-related. Early in his career, he explored for major mining firms, including Homestake Mining Company, Newcrest Mining Ltd., and Newmont Mining Corp.

Dr. Hennigh joined the junior mining sector in 2007 and has been involved with a number of Canadian-listed gold companies, including Gold Canyon Resources, where he led exploration at the Springpole alkaline gold project near Red Lake Ontario, a 5-million-ounce gold asset that was recently sold.

It was in 2010 that Dr. Hennigh helped start NOVO Resources and began assembling its extensive exploration portfolio. Today, NOVO remains one of the world’s most successful resource-space investment specialists.

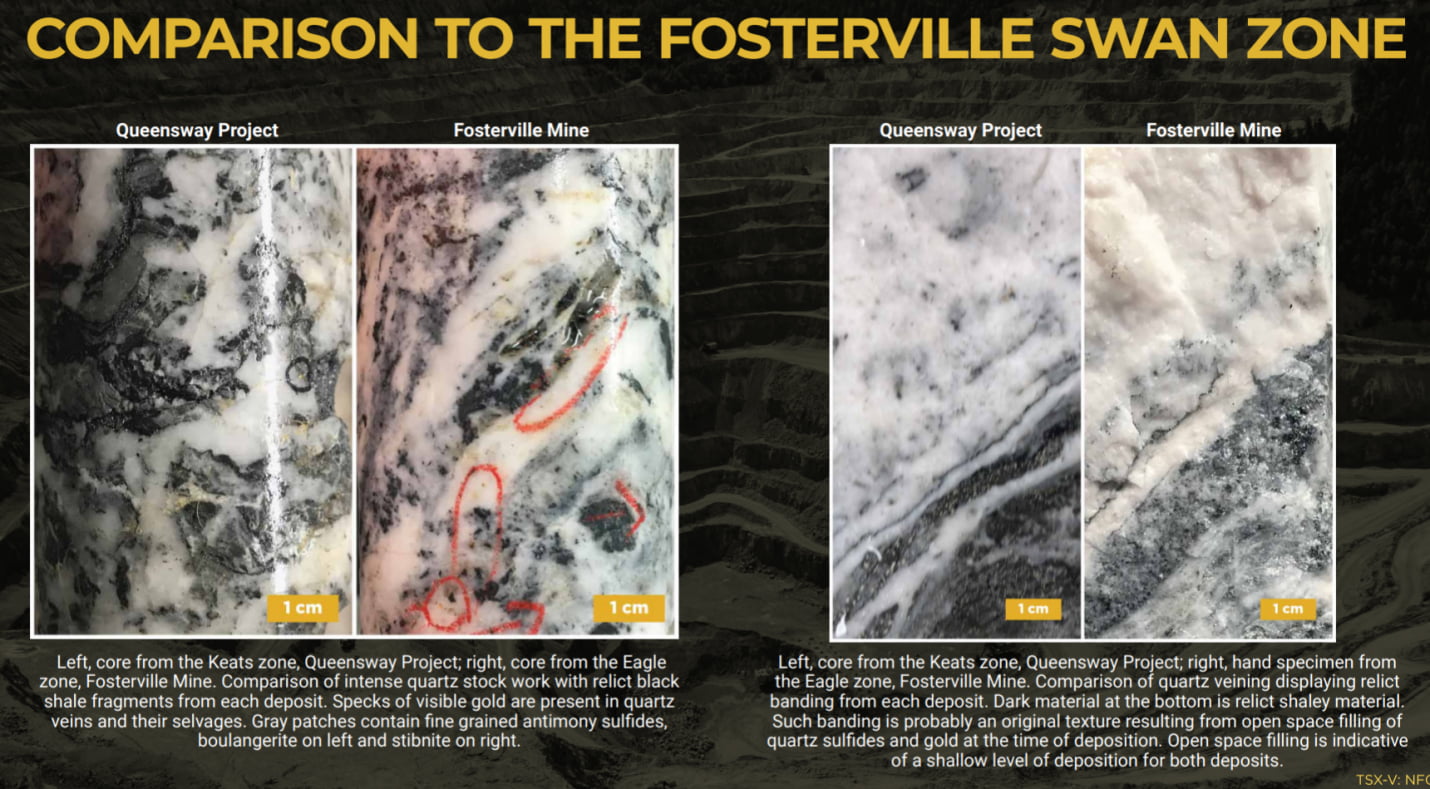

Dr. Hennigh and NOVO Resources’ decision to take a large stake and stay invested in New Found Gold undoubtedly involves the factors we’ve already cited. However, Dr. Hennigh also has a deeper insight into the mineralization potential of New Found Gold’s Newfoundland-based Queensway Project, as it bears striking similarities to the mineral-rich Fosterville Mine – the one that made Kirkland Lake so successful.

At the time that Kirkland Lake acquired Newmarket and its Fosterville Mine, the Swan Zone at Fosterville was in an early stage of discovery. The epizonal model for high-grade gold emplacement in an orogenic system was not widely understood.

Dr. Hennigh’s recognition that newly intersected high-grade gold in the Swan Zone was epizonal in nature implied to him that the Swan Zone had significant size potential for high-grade gold resources – and this was the basis for his strong recommendation to Kirkland Lake that they proceed with the acquisition.

Following a review of photographs of New Found’s Queensway project, Dr. Hennigh concluded that the high-grade gold mineralization intercepted in New Found’s drill hole NFGC-19-01 was epizonal in nature – almost identical to what he had observed at the Fosterville Mine’s Swan Zone.

He concluded that Queensway had the potential for a significant high-grade, near-surface discovery. In other words, this could be the sequel to Fosterville, or even better, and he proceeded to negotiate NOVO Resources’ $15 million investment into New Found Gold.

President Trump is Breaking Down the Neck of the Federal Reserve!

He wants zero rates and QE4!

You must prepare for the financial reset

We are running out of time

Download the Ultimate Reset Guide Now!

Disclaimer/Disclosure Statement

Introduction

We are paid advertisers through any one or several of the following entities, which entities are controlled by the same owners and other owners in varying percentages: (a) Future Money Trends, LLC, (b) Gold Standard Media, LLC; Gold Standard Media, LLC, ShtfPlan.com, Wealth Research Group, LLC, Portfolio Wealth Global, LLC, Wallace Hill Partners, Ltd (hereafter collectively referred to as “we”, “our”, “us”, or “FMT”). As advertisers, we are publishers of publicly disseminated information on behalf of our clients, publicly traded companies, or non-affiliate third party shareholders of various issuers. As reiterated below, do not base an investment decision on any of the contents of our Publications.

Conformity with Anti-Touting Statute – Section 17(b) of the Securities Act of 1933

We receive either monetary or securities compensation for our services in conformity with the anti-touting statute under the federal securities laws, Section 17(b) of the Securities Act of 1933, as amended (“Securities Act”), and requires publishers to provide full disclosure of their compensation, as follows:

- Type of compensation (securities or cash) (if securities, whether common stock, preferred stock, warrants, or other type securities) received, or to be received (distinguish whether such compensation has been received or to be received and when).

- Identify of the party who paid the compensation, including whether such party is the Issuer, a third-party shareholder, or any other person or entity.

- Amount of securities or cash paid, and date paid or will be paid.

Additionally, the following must be disclosed:

- If the compensation is in securities, whether the securities are restricted or unrestricted.

- If a corporate entity is the publisher of the information, its control persons must be identified.

- Identity of Person paying (Direct or Indirect) compensation to the stock promoter; and

- If the Publisher is compensated by a third-party shareholder or corporate entity, the shareholder or control persons of the entity must be identified by his or her individual name.

Do Not Use Any Information in Our Publications to Make an Investment Decision

There is no information on our website or distributed otherwise that should be used as the basis for an investment decision.

What We are Not

We do not act, directly or indirectly, in the capacity of any of the following and you should not construe our activities as involving any of the following: (a) investment advisor; (b) broker dealer; (c) broker; (d) dealer; (e) stock recommender; (f) stock picker; (g) finder; (h) securities trading expert; (i) financial planner; (j) engaging in the offer and sale of securities; (k) securities analyst; (l) financial analyst; (m) providing price targets or buy or sell recommendations.

From Whom We Receive Compensation

We receive cash or stock consideration from Issuers or third-party shareholders. With respect to third party shareholders, please be advised that the SEC has interpreted compensation paid to an investor relations firm from Third Party Shareholders, is considered to have emanated from the Issuer itself. As such, any shares received from a Third Party Shareholder under such circumstances must comply with the applicable holding periods under Rule 144 of the Securities Act since such stock issuances would be considered an issuance by the Issuer and therefore restricted.

Conflicts of Interest

Our activities involve multiple potential and/or actual conflicts of interest, since we receive monetary or securities compensation in the very securities we are promoting, and shortly after we receive the securities compensation, we may promote the securities and sell the securities. The third party shareholder from which we receive compensation also has an actual conflict of interest since he or she or it is paying us securities compensation for promotion services and such non-affiliate third party shareholder may sell other shares held while we are promoting the issuer that issues the stock held by such third party shareholder.

Our Trading

- Note the following regarding our trading activities, including securities compensation we receive:

- We routinely sell the securities before, during and after its dissemination of the Publication.

- Selling of our securities may result in may result in substantial profits to us.

Our buying and selling activities may result in increases in the total trading volume of the securities, which may prove advantageous to our selling activities. - Our buying and selling activities may result in the investing public having to sell at lower trading process, especially if we are selling material amounts of shares.

No Warranties

There are no implied or express warranties regarding the contents of our Publications.

Distribution of the Information in our Publications

The contents of each publication may be distributed, as follows:

- Through our Publications as identified above.

- Sent directly to your email

- Sent to addresses on email lists

- YouTube Channels.

- Re-published by our entity, Gold Standard Media, and sent to select email lists and YouTube Channels booked and scheduled by Gold Standard Media

Mining Disclosure

The Company’s publications often pertain to gold and mining stocks, which discuss a direct relationship between the price of gold or silver and the stock price of a gold or silver mining stock. We discuss with respect to various issuers that there is a relationship between the price of gold or silver to the stock price of a gold or silver mining stock, i.e. that the higher the price of gold or silver, the higher the price of the stock. You should use extreme caution in adopting any such conclusions, because such statements do not account for any of the following factors:

- The stage of mining that the public company is engaged in, i.e. whether they are simply an exploration company and have not entered actual mining operations.

- Whether the then current financial condition of the mining company permits such company to have the necessary capital to conduct exploration and/or mining activities.

- The need for financing for exploration and/or mining activities and the possible inability to obtain such financing at all or on acceptable terms or that does not cause significant dilution to shareholders’ interests.

- Estimates of proven and probable reserves and mineralized material are subject to significant uncertainty, including a determination that the estimated reserves of mineralized material become uneconomical.

- Status of the worldwide economy

- Development of mineral properties is inherently risky and could lead to unproductive properties and is subject to the ability of the mining operator obtaining the necessary capital investments

- Whether additional exploration is required if reserves are not located on already acquired properties, which would negatively impact the financial condition of such gold or silver company or properties or mining operations

- Failure to comply with regulatory requirements

Whether the public company is a development stage company - Mining operations are subject to the risks of increasing operating and capital risks that adversely affect results of operations

- Potential delays, cost overruns, shortages of material or labor, construction defects

Readers should view statements that state that stock prices will be track gold or silver prices with extreme caution and do their research into the Issuer’s or operator’s financial performance, estimated exploration, extraction and production costs, financial condition, stage of exploration and mining, whether its operations are contingent upon financing. Mining operations are subject to innumerable risks and high rates of failure and create a direct relationship between the price of gold or silver and a gold or silver public company in the absence of other factors is misleading, i.e. stage of exploration or mining, financial condition, all operations contingent on financing, high rate of failure of mining operations.

Accordingly, do not rely upon any claimed relationship between the price of gold and silver and the stock price of a gold and/or silver company, and conduct your own research using reliable sources.

Statements contained in our publications that discuss increases in stock prices of mining stocks over a specified period of time that we do designate reflects an arbitrary period of time and does not take into consideration the inherent and specific risk of mining ventures and possible price volatility of a mining stock. Therefore, these statements should not be relied upon. Do your own research from reliable sources. The foregoing also applies to statements in our publication regarding mining test results and their implications, and references to individuals or entities making significant investments in the companies being profiled. Conduct research from reliable sources, including public reports filed by the mining company with regulatory authorities.

Penny Stock Disclosure

Many of the securities we profile are considered penny stocks. Penny stocks inherently involve high risk and price volatility. You may lose your entire investment in any penny stock that you invest in. You should be acutely aware of the following information and risks inherent in any penny stock investment that you may make, including any issuer profiled on our websites or otherwise: (a) we receive monetary or securities compensation from persons that claim they are a non-affiliate shareholder or an issuer; however, we conduct no due diligence whatsoever to determine whether in fact they are a non-affiliate; (b) there is an inherent conflict of interest between our information dissemination services involving various issuers and our receipt of compensation from those same issuers; (c) we may buy and sell securities in the securities that we provide information dissemination services, which may cause significant volatility in the issuer’s stock, price declines from our selling activities, permit us to make substantial profits while we are disseminating profiles or information about the issuer, yet may result in a diminished value to the stock for investors; (c) we conduct no due diligence on the content of our Publications; (d) Penny stocks are subject to the SEC’s penny stock rules and subject broker-dealers to customer suitability rules and other requirements, which may lead to low volume in the securities and/or difficulties in selling the shares; (e) penny stocks are often thinly traded or have low trading volume, which may lead to difficulties in selling your securities and extreme price volatility; (f) many of the penny stocks we profile or provide information about are subject to intense competition, extreme regulatory oversight and inadequate financing to pursue their operational plan; (g) the issuer profiles and information we provide is wholly insufficient to formulate an investment decision and should not be used in any way as a basis for making an investment decision and, at the most, it should be used a starting point from which you conduct an in-depth investigation of the issuer from available public sources, such as www.sec.gov, www otcmarkets.com, www.sec.gov, yahoofinance.com, www.google.com and other available public sources as well as consulting with your financial professional, investment adviser, registered representative with a registered securities broker-dealer; (h) we urge you to conduct an in-depth investigation of the issuer from the above or other available sources, especially because we only present positive information, which is an insufficient basis to invest in any stock, yet alone a penny stock; accordingly, you should proceed with such investigation to determine, among other things, information pertaining to the issuer’s financial condition, operations, business model, and risks involved in the issuer’s business; (i) the issuers we profile may have negative signs on the otcmarkets.com website (i.e. Stop Sign, No Information, Limited Information, Caveat Emptor), which you should determine from entering the symbol of the stock profiled into the otcmarkets.com website; (j) you should determine whether the issuer we profile or provide information about is a development stage company, which is subject to the risks of a development stage company in a similar such business, including difficulties in obtaining financing for operations and future growth; (k) because we only present positive information regarding an issuer, ; you should conduct an in-depth investigation of any possible negative factors regarding such issuer; (l) our information is “as is” and you your use of the information is at your own risk and such information may change at any time and it is not based upon any verification or due diligence of the statements made; (m) we state that profiled stocks are consistent with future economic trends; however, future economic trends or analysis has its own limitations, including: (i) due to the complexity of economic analysis as well as the individual financial and operational characteristics of an individual issuer, such economic trends or predictions may amount to nothing more than speculation; (ii) consumers, producers, investors, borrowers, lenders and government may react in unforeseen ways and be affected by behavioral biases; (iii) human and social factors may outweigh future economic trends and predictions that we state may or will occur; (iv) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (v) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in such economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of fully new circumstances and situations in which uncertainty becomes reality rather than of predictive economic quality; (vi) if the trends involves a single result, it ignores all other scenarios that may be crucial to make a decision in the event of various contingencies; (n) the information we disseminate about issuers contain forward looking statements, i.e. statements or discussions that constitute predictions, expectations, beliefs, plans, estimates, projections as indicated by such words as “expects”, “will”, “anticipates”, “estimates; therefore, you should proceed with extreme caution in relying upon such statements and conduct a full investigation into any such forward looking statements; (o) forward looking statements are limited to the time period in which they are made and we do not undertake to update forward looking statements that may change at any time; and (p) we make statements in our profiles that an issuer’s stock price has increased over a certain period of time; however, these statements only reflects an arbitrary period of time, and is of little or no predictive or analytical quality.

Compensation

On July 22nd, 2020, in connection with our agreement with New Found Gold Corp, we received $235,467USD to Gold Standard Media LLC. On April 24th, 2020, in connection with our agreement with New Found Gold Corp, we received $133,342.USD to Gold Standard Media LLC. We contracted with New Found Gold Corp to provide advertising services for a period of 24 months.