Rob McEwen Is Heavily Involved

In the mining sector, there are TWO WAYS of gaining leverage with the underlying spot price.

The operational miners have MARGIN LEVERAGE, since for every few percentage points that gold rises (assuming the company’s expenses stay the same), the PROFIT MARGIN increases.

I love that TYPE OF LEVERAGE, and it is best capitalized on at the early stages of a bull market. The large-cap, world-class miners move first, since the change in valuation is instant and obvious. You always want exposure to the miners early on; most of the BEST-IN-CLASS companies will surge by more than 100% in a matter of months.

That initial rally is BEHIND US.

Once the GDX index begins moving, it tends to rally BEFORE the GDXJ, which is comprised of smaller companies. Most of them have either small mines or development-stage projects.

These mid-tier companies have the SECOND FORM of leverage, which is called RESERVE & RESOURCE MULTIPLE.

This one is MUCH MORE volatile, but offers way more potential, in terms of rewards.

In fact, Eric Sprott, the legendary resource-sector asset manager, as well as his most trusted analyst, the legendary Rick Rule, both mention instances of seeing 100:1 returns, using this strategy.

Making 100 TIMES one’s principal capital is both life-changing and rare. Making 10 times one’s seed investment is ACTUALLY REALISTIC and happens often in the gold sector.

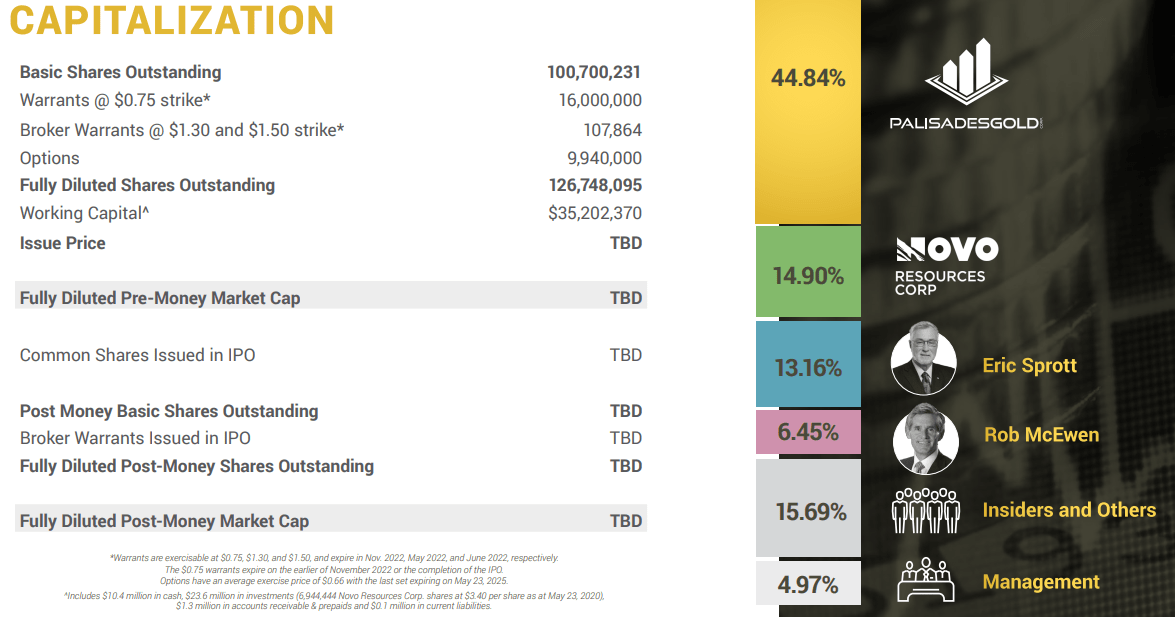

Eric Sprott is NewFound Gold’s (TSX-V: NFG) largest individual shareholder, so we already know what his STATE OF MIND is regarding the potential here.

This is one reason Wealth Research Group believes that you should consider becoming a shareholder of this company. The SECOND REASON is even more IMPORTANT, as we see it.

The second reason is that the company’s SECOND-LARGEST individual shareholder has these accomplishments UNDER HIS BELT:

- Founder and CEO of Goldcorp, which had merged with Newmont a few years back to form the 2nd largest gold producer on the planet.

- One of the TOP-100 richest men in Canada.

- A 2017 mining hall of fame inductee.

- Since the early 2000s, he has won mining entrepreneur of the year by Ernest & Young, PDAC developer of the year and most innovative CEO of the year awards.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

Rob McEwen is worth $800M, according to the latest numbers, but that’s probably wrong by a few hundred million dollars by now, after gold’s recent rally.

McEwen has built a HUGE MINING operation with Goldcorp.

There lies my thesis why NewFound Gold has attracted both Eric Sprott, who is interested in ASSET LEVERAGE and Rob McEwen, who knows all about OPERATIONAL LEVERAGE.

This company has both!

CONSIDER SHARES OF NEWFOUND GOLD (TSX-V: NFG) NOW!

Prosperous Regards,

Mac Slavo

President Trump is Breaking Down the Neck of the Federal Reserve!

He wants zero rates and QE4!

You must prepare for the financial reset

We are running out of time

Download the Ultimate Reset Guide Now!

Disclaimer/Disclosure:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. You should know that we have been compensated, directly by NewFound Gold, seven hundred and fifty thousand dollars for a five year agreement, for pre IPO marketing, consulting and public awareness. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at SHTFPlan.com/disclaimer