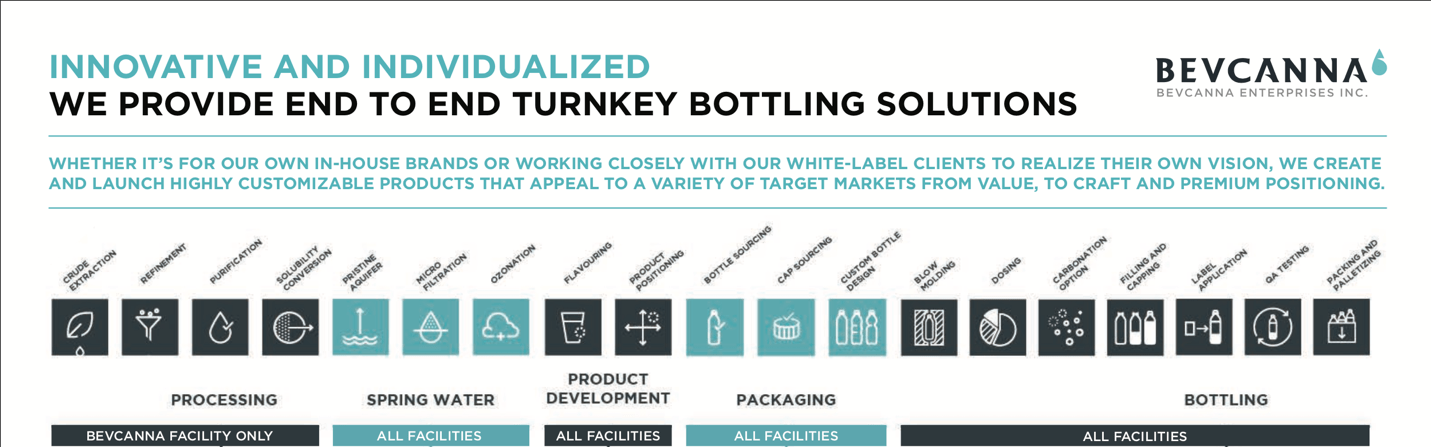

One company owns a pristine alkaline spring water aquifer and a 40,000-square-foot, HACCP certified manufacturing facility that can manufacture up to 210 million bottles each and every year.

BevCanna Enterprises Inc. (CAD: BEV & US: BVNNF) BevCanna develops and manufactures a range of plant-based and cannabis beverages and nutraceuticals for both in-house brands and white-label clients.

In other words, it owns the ONLY (this is confirmed) high-capacity manufacturing facility in Canada that is licensed for both Health Canada approved cannabis production (10,000 sqft) and traditional CPG production (30,000 sqft).

With decades of experience creating and distributing iconic brands that have resonated with consumers on a global scale, BevCanna’s team demonstrates an expertise that is unmatched in the emerging cannabis beverage category.

That team is lead by CEO Marcello Leone, a visionary veteran executive; President, Melise Panetta, an accomplished Senior Marketing and Sales executive with extensive career at leading organizations such as S. C. Johnson, General Mills and PepsiCo.; as well as CFO and CSO John Campbell, who has more than 30 years of experience in the investment industry.

Also on the BevCanna team are leaders and influencers across multiple business segments:

- Executive Branding and Marketing Advisor Keith Stride, a 25-year marketing and advertising veteran and expert in consumer branding and strategy, including a CMO role at Hemptown USA. Mr. Stride is internationally recognized for his work in building high-profile brands such as Best Buy, Rogers, TD Bank, Mark’s, Whistler-Blackcomb and RBC.

- VP of Sales, Raffael Kapusty, an accomplished CPG industry leader with more than 25 years of experience in both the Canadian and U.S. retail spaces. Most recently, Raffael led sales and marketing at Ice Age Glacial Water Company, successfully growing points of distribution in the natural products sector and expanding into mainstream grocery. With a solid foundation at ACNielsen Canada, Raffael has developed a deep understanding of the CPG space, working with over 100 leading Canadian & global CPG manufacturers. She has also held senior category and key account management roles at Kruger, SCJohnson and Unilever Canada.

- VP of Sales, Bill Niarchos, has over 20 years of experience in the CPG goods industry/retail environment. In his most recent role as Director of Sales with Bayer Consumer Health, Bill managed the strategic direction and growth of Loblaw & SDM. Prior to his position with Bayer, Bill held a number of progressive roles at Colgate Palmolive for more than 14 years. Bill is experienced in managing all trade channels in various capacities, including as National Account Manager – Walmart and Costco, Director of Sales – Drug Channel, Director Customer Development – Mass and Club and Director of Customer Development – Loblaw Companies Limited (including SDM).

- Executive Management Advisor, Keith Dolo, previously served as CEO and Executive Chairman of Sproutly Inc. Previous to Sproutly, he served for over 13 years with Robert Half, an S&P 500, NYSE listed company, specifically in the role of Vice President for the last 8 years. Mr. Dolo is well versed in clarifying the external and internal competitive landscape, unearthing opportunities for expansion, serving customers, and leveraging new industry developments and standards.

- Head of Quality Assurance Japheth Noah, Oxford and MIT educated quality and regulatory manager with over 15 years’ experience in beverage, pharmaceutical, natural health, and medical industries.

With decades of collective experience on its side, BevCanna is poised to unlock the full potential of the global cannabis, wellness, and beverage markets.

In February 2021, BevCanna completed its transformative acquisition of established beverage company Naturo Group. With the recent completion of this acquisition, BevCanna is evolving into a diversified comprehensive health and wellness company.

It’s a highly value-added business combination as it allows BevCanna to offer one of the most

unique and diverse portfolios of beverage and wellness products within both the cannabis as well as the plant-based CPG categories.

BevCanna is in the unique position of being one of the only fully licensed, in-house and white-label beverage manufacturing companies that distributes both traditional CPG and cannabis-based beverage and wellness products. Creating a diversified health and wellness; beverage and natural products company, with $55M+ in assets on the balance sheet, and a global multi-channel sales and distribution network positioned for growth.

Here are the specs, including the details on the business combination and the manufacturing facility:

- BevCanna now holds direct ownership of Naturo Group’s 40,000 sq. ft., high-capacity beverage facility, and 315-acres of outdoor cultivatable land valued at $10.4 million, and beverage manufacturing equipment valued at $3.4 million (as of year-end 2020), along with a proprietary Health Canada approved fulvic and humic plant-based mineral formulation. The specs of the manufacturing facility are as follows:

- Capacity is 1,165 liters per minute with existing wells

- bottling capacity: 210 million bottles per annum

- HACCP certified, GMP and Health Canada cannabis approved facility

- Facility is situated on 5 acres of light industrial zoning within the 315 acres of Agricultural Land Reserve

- ALC pre-approval for 7-phase expansion to 170,000 square feet

- Specialty equipment: flash pasteurizer and bottle form blower machine

- Dual production line allows for non-stop production

- Production line technology allows for innovative manufacturing techniques for flat, sparkling, hot and cold infused beverages

- CFIA Health Canada Food Doctorate approval for beverages in Canada

- BevCanna also directly owns of one of Naturo Group’s most valuable assets, their exclusive on-site alkaline spring water source, independently valued at $18 million.

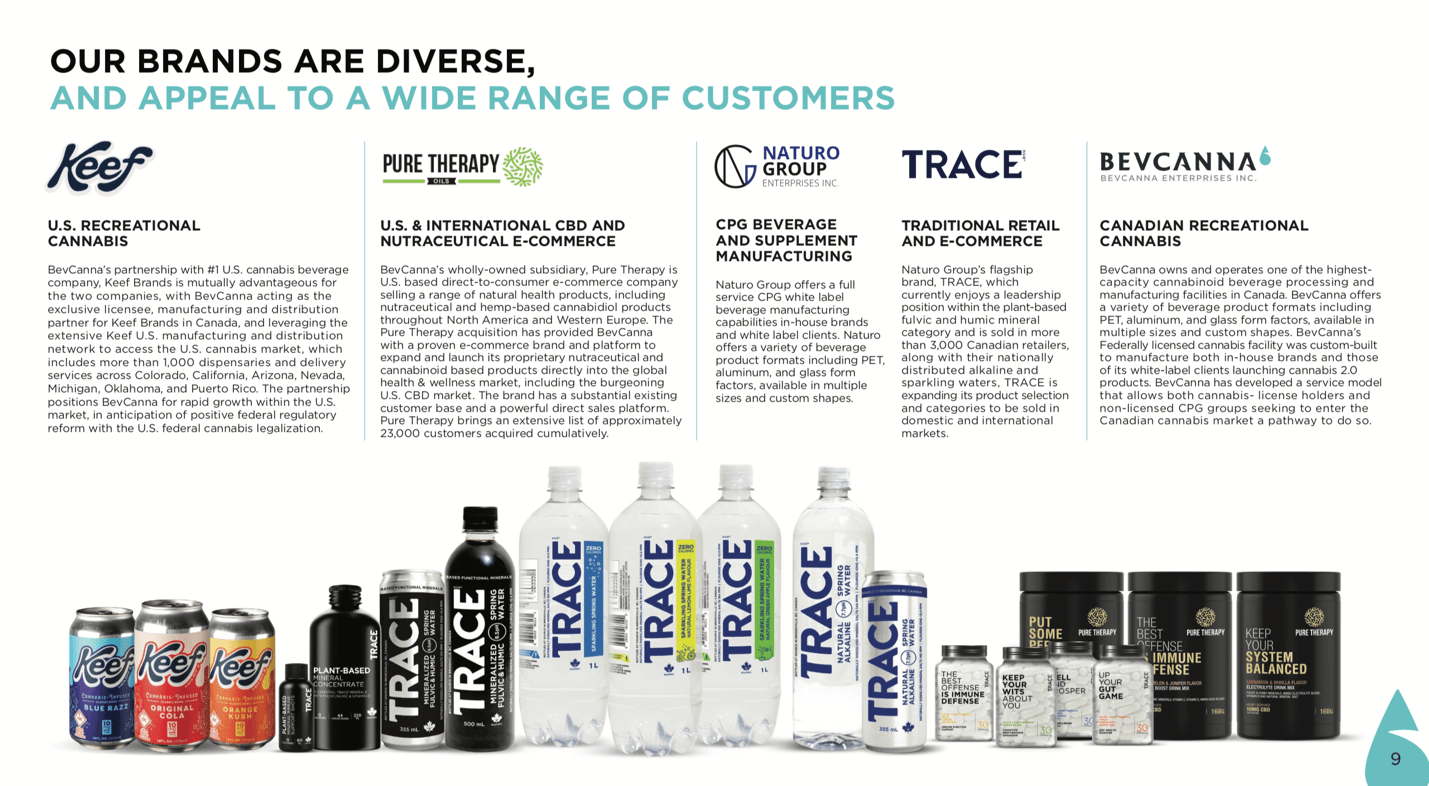

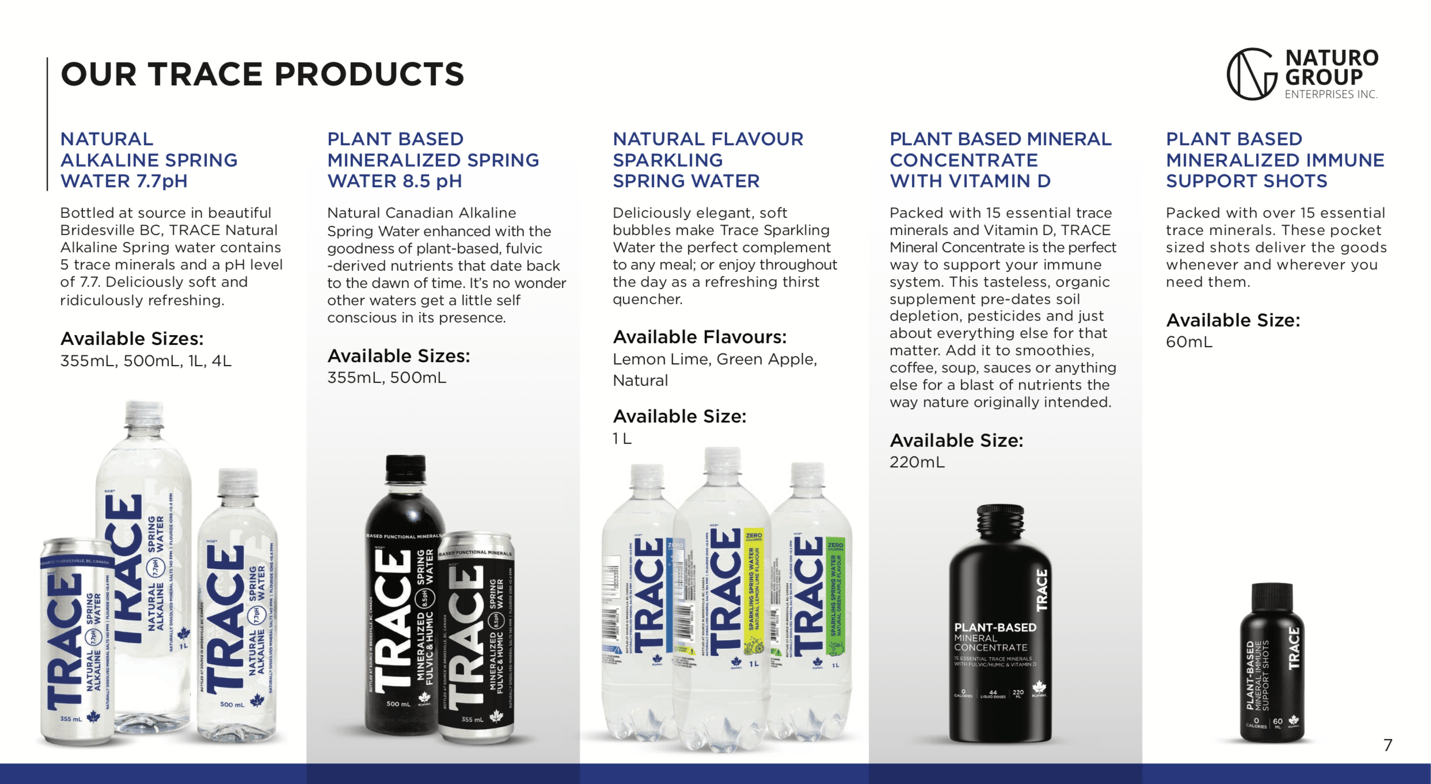

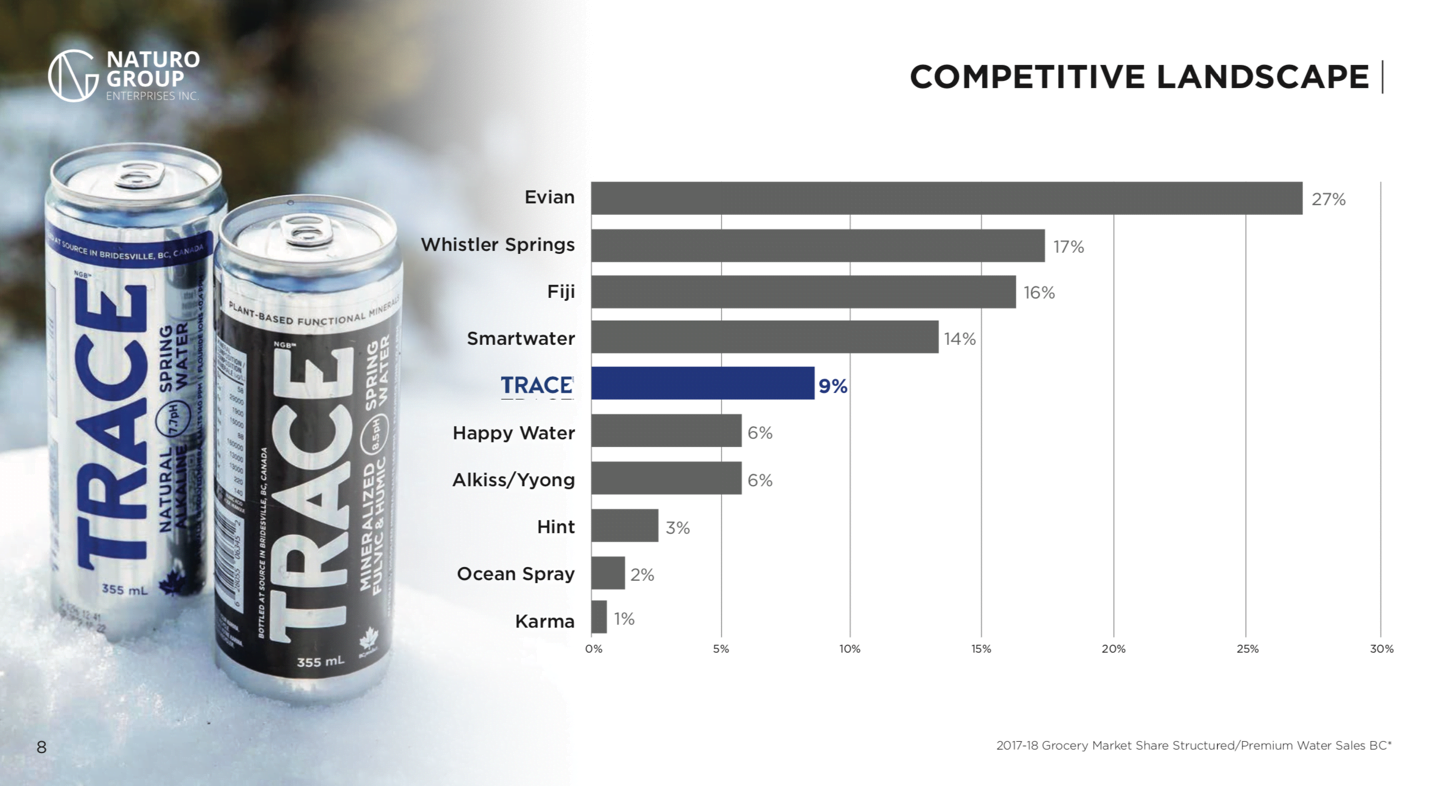

- On top of all that, BevCanna also owns Naturo Group’s flagship brand, TRACE, which currently enjoys a leadership position within the Canadian plant-based fulvic and humic mineral category and is sold in more than 3,000 Canadian retailers, with select international agreements and partnerships under review.

As water resources become increasingly scarce, BevCanna expects that the proprietary on-site alkaline spring water source will contribute to a strengthened balance sheet and to BevCanna’s unique positioning within the burgeoning plant-based and cannabis sectors.

Just by itself, the TRACE acquisition adds tremendous value to the company. Along with their nationally distributed plant-based mineral beverages and nutraceuticals, as well as alkaline and sparkling waters, TRACE is expanding its product selection to include additional nutraceutical formats, and additional consumer products, to be sold in domestic and international markets.

With a proprietary formulation process, TRACE plant-based mineral beverages are sourced from the highest quality alkaline spring water in the British Columbia interior of Canada – thus allowing these beverages to be featured next to premium enhanced spring water brands such as Fiji, Smart Water, and Evian.

TRACE fits into both Millennials’ and Gen Z’s product preferences perfectly. The natural, slow filtration of pristine back-country rain and melted snow through layers of rock and stone help create TRACE’s unique spring water, providing a subtly pure flavor from dissolved trace minerals.

We’re talking about a pure spring water aquifer with a natural +pH7.7 straight from the aquifer – it’s as pristine as it gets. The alkaline water is bottled at the source, untouched by man, and provides an untapped capacity as the aquifer has been self-replenishing for the past 70 years, utilizing only 1.5% of the water table per year.

The timing for BevCanna to acquire the TRACE brand couldn’t be any better, as the bottled water market is valued at more than CAD$20bn in North America alone and the enhanced premium spring water category continues to expand quickly with 62% growth in the last 2 years.

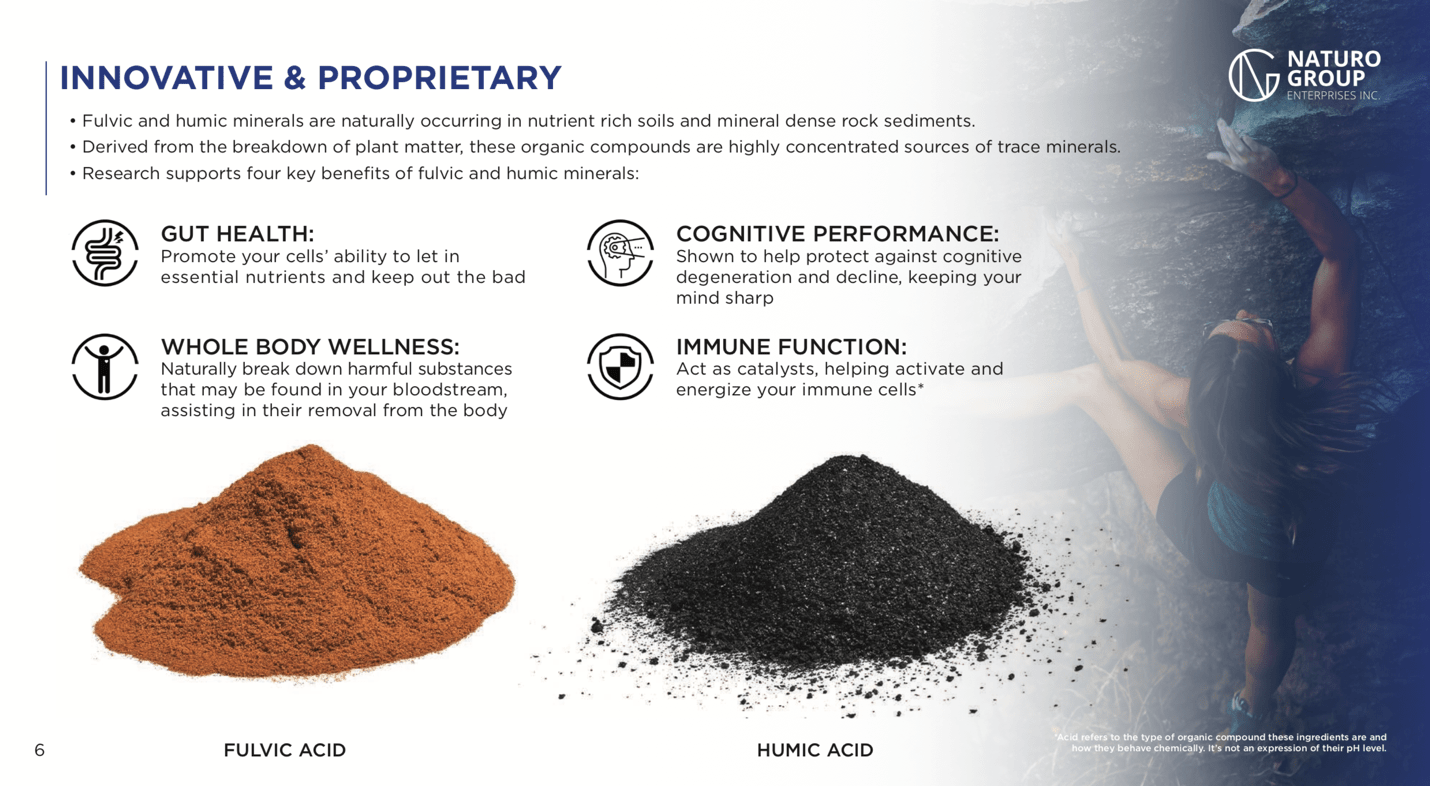

Research supports four key benefits of fulvic and humic minerals:

- Gut Health: Promote your cells’ ability to let in essential nutrients and keep out the bad.

- Immune Function: Act as catalysts, helping activate and energize your immune cells.

- Cognitive Performance: Shown to help protect against cognitive degeneration and decline, keeping your mind sharp.

- Whole-body Wellness: Naturally break down harmful substances that may be found in your bloodstream, assisting in their removal from the body.

On the competitive landscape, the TRACE brand is gaining traction and moving up the ranks quickly. Much of this is due to word-of-mouth and of course the pure quality of the TRACE brand, but the company’s awareness campaigns also enhance the overall footprint of the brand – now available at 3,000 stores and counting.

Continuous brand awareness is developed for TRACE through campaigns including:

- Official Water of the Whitecaps FC

- Proud provider of our Alkaline Spring Water to the valiant forest firefighters in BC

- Official Water of the Finish Line at Vancouver’s annual BMO Marathon

- Canada’s Walk of Fame

- Just for Laughs

2020 was a banner year for BevCanna, as the company also acquired natural health and wellness e-commerce retailer Pure Therapy in September.

Pure Therapy is a direct-to-consumer e-commerce company that sells a range of natural health products, including nutraceutical and hemp-based cannabidiol products throughout North America and Western Europe.

This acquisition provides BevCanna with a proven e-commerce brand and platform to further expand and launch its own propriety products directly into the U.S. and global health and wellness market, including the burgeoning U.S. CBD market.

Pure Therapy’s extensive catalogue of formulations is proprietary and professionally crafted based on market demand and product quality. The company brings an extensive list of 23,000 customers, and the brand achieved unaudited calendar year 2019 gross revenues of C$4,768,000.

BevCanna projects further growth in the brand through new product integration and by accelerating the growth of the existing natural health products line, leveraging the extensive e-commerce marketing expertise of the existing Pure Therapy team.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

The company forecasts gross revenue of C$7.28 million with positive EBITDA in 2021 for Pure Therapy – overall, the current mix of subscription-based and traditional sales revenue will provide a strong recurring revenue stream for BevCanna.

BevCanna is also poised for rapid growth in the U.S. recreational cannabis market through a strategic alliance with the #1 cannabis beverage company in the United States, Keef Brands.

Keef Brands currently offers eight of the top ten-selling cannabis beverages in Colorado as well as two of the ten top-selling ones in California. Keef Brands also ranks first in the U.S. both in units and dollars sold among all cannabis beverage companies.

According to the agreement, BevCanna will act as the exclusive licensee, manufacturing and distribution partner to the award-winning U.S. line of Keef infused beverages for the Canadian market.

Courtesy: Keef Brands

Plus, BevCanna will leverage the extensive Keef U.S. manufacturing and distribution network to access the U.S. cannabis market, which includes more than 1,000 dispensaries and delivery services across Colorado, California, Arizona, Nevada, Michigan, Oklahoma, and Puerto Rico.

Moreover, Keef Brands has taken an equity position in BevCanna. Clearly, Keef Brands’ investment in BevCanna reflects their strong confidence in the Canadian beverage manufacturer and the continued strengthening of the relationship between the two companies.

With an unbeatable leadership team, multiple established brands under its umbrella, and strategic acquisitions and joint ventures to place it ahead of the competition, BevCanna Enterprises is on the cusp of a breakthrough moment in multiple hyper-expansive North American and international product markets today.

Additionally, BevCanna entered into an exclusive joint venture with prominent U.S. vape and high-end extracts company Bloom to cover both the Canadian and U.S markets.

Deeply rooted in California, Bloom is consistently one of the top vape brands across multiple major U.S. recreational and medical markets. A known premium brand, Bloom is a winner of the Chalice Cup and Cannabis Cup Awards for both the quality and popularity of their distillate and proprietary strains.

The products are to be sold under the Cali-Bloom name, with the Bloom brand beverages in North America to be manufactured by BevCanna.

Conduct your research on BevCanna Enterprises (US: BVNNF)!

President Trump is Breaking Down the Neck of the Federal Reserve!

He wants zero rates and QE4!

You must prepare for the financial reset

We are running out of time

Download the Ultimate Reset Guide Now!

Disclaimer/Disclosure Statement

Introduction

We are paid advertisers through any one or several of the following entities, which entities are controlled by the same owners and other owners in varying percentages: (a) Future Money Trends, LLC, (b) Gold Standard Media, LLC; Gold Standard Media, LLC, ShtfPlan.com, Wealth Research Group, LLC, Portfolio Wealth Global, LLC, Wallace Hill Partners, Ltd (hereafter collectively referred to as “we”, “our”, “us”, or “FMT”). As advertisers, we are publishers of publicly disseminated information on behalf of our clients, publicly traded companies, or non-affiliate third party shareholders of various issuers. As reiterated below, do not base an investment decision on any of the contents of our Publications.

Conformity with Anti-Touting Statute – Section 17(b) of the Securities Act of 1933

We receive either monetary or securities compensation for our services in conformity with the anti-touting statute under the federal securities laws, Section 17(b) of the Securities Act of 1933, as amended (“Securities Act”), and requires publishers to provide full disclosure of their compensation, as follows:

- Type of compensation (securities or cash) (if securities, whether common stock, preferred stock, warrants, or other type securities) received, or to be received (distinguish whether such compensation has been received or to be received and when).

- Identify of the party who paid the compensation, including whether such party is the Issuer, a third-party shareholder, or any other person or entity.

- Amount of securities or cash paid, and date paid or will be paid.

Additionally, the following must be disclosed:

- If the compensation is in securities, whether the securities are restricted or unrestricted.

- If a corporate entity is the publisher of the information, its control persons must be identified.

- Identity of Person paying (Direct or Indirect) compensation to the stock promoter; and

- If the Publisher is compensated by a third-party shareholder or corporate entity, the shareholder or control persons of the entity must be identified by his or her individual name.

Do Not Use Any Information in Our Publications to Make an Investment Decision

There is no information on our website or distributed otherwise that should be used as the basis for an investment decision.

What We are Not

We do not act, directly or indirectly, in the capacity of any of the following and you should not construe our activities as involving any of the following: (a) investment advisor; (b) broker dealer; (c) broker; (d) dealer; (e) stock recommender; (f) stock picker; (g) finder; (h) securities trading expert; (i) financial planner; (j) engaging in the offer and sale of securities; (k) securities analyst; (l) financial analyst; (m) providing price targets or buy or sell recommendations.

From Whom We Receive Compensation

We receive cash or stock consideration from Issuers or third-party shareholders. With respect to third party shareholders, please be advised that the SEC has interpreted compensation paid to an investor relations firm from Third Party Shareholders, is considered to have emanated from the Issuer itself. As such, any shares received from a Third Party Shareholder under such circumstances must comply with the applicable holding periods under Rule 144 of the Securities Act since such stock issuances would be considered an issuance by the Issuer and therefore restricted.

Conflicts of Interest

Our activities involve multiple potential and/or actual conflicts of interest, since we receive monetary or securities compensation in the very securities we are promoting, and shortly after we receive the securities compensation, we may promote the securities and sell the securities. The third party shareholder from which we receive compensation also has an actual conflict of interest since he or she or it is paying us securities compensation for promotion services and such non-affiliate third party shareholder may sell other shares held while we are promoting the issuer that issues the stock held by such third party shareholder.

Our Trading

- Note the following regarding our trading activities, including securities compensation we receive:

- We routinely sell the securities before, during and after its dissemination of the Publication.

- Selling of our securities may result in may result in substantial profits to us.

Our buying and selling activities may result in increases in the total trading volume of the securities, which may prove advantageous to our selling activities. - Our buying and selling activities may result in the investing public having to sell at lower trading process, especially if we are selling material amounts of shares.

No Warranties

There are no implied or express warranties regarding the contents of our Publications.

Distribution of the Information in our Publications

The contents of each publication may be distributed, as follows:

- Through our Publications as identified above.

- Sent directly to your email

- Sent to addresses on email lists

- YouTube Channels.

- Re-published by our entity, Gold Standard Media, and sent to select email lists and YouTube Channels booked and scheduled by Gold Standard Media

Mining Disclosure

The Company’s publications often pertain to gold and mining stocks, which discuss a direct relationship between the price of gold or silver and the stock price of a gold or silver mining stock. We discuss with respect to various issuers that there is a relationship between the price of gold or silver to the stock price of a gold or silver mining stock, i.e. that the higher the price of gold or silver, the higher the price of the stock. You should use extreme caution in adopting any such conclusions, because such statements do not account for any of the following factors:

- The stage of mining that the public company is engaged in, i.e. whether they are simply an exploration company and have not entered actual mining operations.

- Whether the then current financial condition of the mining company permits such company to have the necessary capital to conduct exploration and/or mining activities.

- The need for financing for exploration and/or mining activities and the possible inability to obtain such financing at all or on acceptable terms or that does not cause significant dilution to shareholders’ interests.

- Estimates of proven and probable reserves and mineralized material are subject to significant uncertainty, including a determination that the estimated reserves of mineralized material become uneconomical.

- Status of the worldwide economy

- Development of mineral properties is inherently risky and could lead to unproductive properties and is subject to the ability of the mining operator obtaining the necessary capital investments

- Whether additional exploration is required if reserves are not located on already acquired properties, which would negatively impact the financial condition of such gold or silver company or properties or mining operations

- Failure to comply with regulatory requirements

Whether the public company is a development stage company - Mining operations are subject to the risks of increasing operating and capital risks that adversely affect results of operations

- Potential delays, cost overruns, shortages of material or labor, construction defects

Readers should view statements that state that stock prices will be track gold or silver prices with extreme caution and do their research into the Issuer’s or operator’s financial performance, estimated exploration, extraction and production costs, financial condition, stage of exploration and mining, whether its operations are contingent upon financing. Mining operations are subject to innumerable risks and high rates of failure and create a direct relationship between the price of gold or silver and a gold or silver public company in the absence of other factors is misleading, i.e. stage of exploration or mining, financial condition, all operations contingent on financing, high rate of failure of mining operations.

Accordingly, do not rely upon any claimed relationship between the price of gold and silver and the stock price of a gold and/or silver company, and conduct your own research using reliable sources.

Statements contained in our publications that discuss increases in stock prices of mining stocks over a specified period of time that we do designate reflects an arbitrary period of time and does not take into consideration the inherent and specific risk of mining ventures and possible price volatility of a mining stock. Therefore, these statements should not be relied upon. Do your own research from reliable sources. The foregoing also applies to statements in our publication regarding mining test results and their implications, and references to individuals or entities making significant investments in the companies being profiled. Conduct research from reliable sources, including public reports filed by the mining company with regulatory authorities.

Penny Stock Disclosure

Many of the securities we profile are considered penny stocks. Penny stocks inherently involve high risk and price volatility. You may lose your entire investment in any penny stock that you invest in. You should be acutely aware of the following information and risks inherent in any penny stock investment that you may make, including any issuer profiled on our websites or otherwise: (a) we receive monetary or securities compensation from persons that claim they are a non-affiliate shareholder or an issuer; however, we conduct no due diligence whatsoever to determine whether in fact they are a non-affiliate; (b) there is an inherent conflict of interest between our information dissemination services involving various issuers and our receipt of compensation from those same issuers; (c) we may buy and sell securities in the securities that we provide information dissemination services, which may cause significant volatility in the issuer’s stock, price declines from our selling activities, permit us to make substantial profits while we are disseminating profiles or information about the issuer, yet may result in a diminished value to the stock for investors; (c) we conduct no due diligence on the content of our Publications; (d) Penny stocks are subject to the SEC’s penny stock rules and subject broker-dealers to customer suitability rules and other requirements, which may lead to low volume in the securities and/or difficulties in selling the shares; (e) penny stocks are often thinly traded or have low trading volume, which may lead to difficulties in selling your securities and extreme price volatility; (f) many of the penny stocks we profile or provide information about are subject to intense competition, extreme regulatory oversight and inadequate financing to pursue their operational plan; (g) the issuer profiles and information we provide is wholly insufficient to formulate an investment decision and should not be used in any way as a basis for making an investment decision and, at the most, it should be used a starting point from which you conduct an in-depth investigation of the issuer from available public sources, such as www.sec.gov, www otcmarkets.com, www.sec.gov, yahoofinance.com, www.google.com and other available public sources as well as consulting with your financial professional, investment adviser, registered representative with a registered securities broker-dealer; (h) we urge you to conduct an in-depth investigation of the issuer from the above or other available sources, especially because we only present positive information, which is an insufficient basis to invest in any stock, yet alone a penny stock; accordingly, you should proceed with such investigation to determine, among other things, information pertaining to the issuer’s financial condition, operations, business model, and risks involved in the issuer’s business; (i) the issuers we profile may have negative signs on the otcmarkets.com website (i.e. Stop Sign, No Information, Limited Information, Caveat Emptor), which you should determine from entering the symbol of the stock profiled into the otcmarkets.com website; (j) you should determine whether the issuer we profile or provide information about is a development stage company, which is subject to the risks of a development stage company in a similar such business, including difficulties in obtaining financing for operations and future growth; (k) because we only present positive information regarding an issuer, ; you should conduct an in-depth investigation of any possible negative factors regarding such issuer; (l) our information is “as is” and you your use of the information is at your own risk and such information may change at any time and it is not based upon any verification or due diligence of the statements made; (m) we state that profiled stocks are consistent with future economic trends; however, future economic trends or analysis has its own limitations, including: (i) due to the complexity of economic analysis as well as the individual financial and operational characteristics of an individual issuer, such economic trends or predictions may amount to nothing more than speculation; (ii) consumers, producers, investors, borrowers, lenders and government may react in unforeseen ways and be affected by behavioral biases; (iii) human and social factors may outweigh future economic trends and predictions that we state may or will occur; (iv) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (v) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in such economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of fully new circumstances and situations in which uncertainty becomes reality rather than of predictive economic quality; (vi) if the trends involves a single result, it ignores all other scenarios that may be crucial to make a decision in the event of various contingencies; (n) the information we disseminate about issuers contain forward looking statements, i.e. statements or discussions that constitute predictions, expectations, beliefs, plans, estimates, projections as indicated by such words as “expects”, “will”, “anticipates”, “estimates; therefore, you should proceed with extreme caution in relying upon such statements and conduct a full investigation into any such forward looking statements; (o) forward looking statements are limited to the time period in which they are made and we do not undertake to update forward looking statements that may change at any time; and (p) we make statements in our profiles that an issuer’s stock price has increased over a certain period of time; however, these statements only reflects an arbitrary period of time, and is of little or no predictive or analytical quality.

Compensation

On March third twenty twenty one, in connection with our agreement with Bevcanna Enterprises Inc., we received USD five hundred thousand dollars, from Bevcanna Enterprises Inc. On March 9th, 2021, we purchased 2.5 million warrants directly from the company.