The sub-prime mortgage meltdown was the catalyst that rocked global financial markets and wiped out trillions of dollars of net worth around the world.

According to Dr. Berninger at Beinger.de, if you thought that was bad, then you ain’t seen nothin’ yet.

The Next Financial Crisis is About to Emerge:

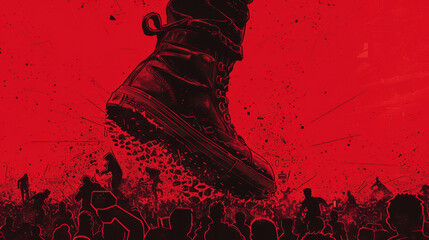

This new crisis will hit the public with vengeance. It will have more dramatic and harsh effects than the subprime crisis, as people, central banks and governments have used up their reserves. There are no silver bullets left to deal with a crisis which might be twice as big as the subprime crisis.

This time it might finally break the international business and trade structures and lead to a significant structure in businesses and supplies. While we already notice the effects of supply destruction, many businesses have kept employees or put them on short time work. With the next wave of financial destruction there is no room to keep those workers on the waiting list.

The next wave is about to hit the markets and it will most likely drive the world into a depression, mirroring or exceeding the 29 depression levels.

Individual preparation is key. This does not only include financial preparation and positioning. To survive the coming depression it requires more than financial skills.

The IMF, with funds being contributed by G20 nations, boosted their crisis fun 10-fold to $550 billion dollars, funds that are to be spent in the event of an economic crisis. It’s a safe bet to say that countries in need will be tapping those funds soon. The IMF and member nations must have realized that a really big problem is around the corner, and it’s not only going to affect banks and financial markets, but governments as well.

Couple the major problems in commercial real estate with ARM mortgage rate resets which are beginning now and will continue through 2012, and it is clear that the crisis is not yet behind us, but will continue for years to come adversely affecting individuals, businesses and governments.

Former Secratary of State Henry Paulson claimed that we were “on the brink” of global financial disaster in 2008 and that if the system was allowed to fail there would be tanks in the streets of America.

As Dr. Berninger suggested in his article – governments have run out of bullets. If an already fragile global economic system is hit with another massive financial crisis, be it in Europe or the USA, the ramifications will be serious and life as we have become accustomed to can quickly spiral out of control.

Hat tip Paul Revere

0 Comments