This article was contributed by Portfolio Wealth Global.

No, we don’t think hyperinflation is coming!

How can inflation bazooka higher, when half of young adults live with their parents in 2020 and 38% of Americans are consumed with thoughts about how to make ends meet?

This doesn’t mean that gold and silver can’t or won’t rally in 2021 (inflation has been below 2% for over a decade), since gold responds to real yields, which are measured by 10-yr yield, subtracted by CPI. So even with CPI at current levels (disinflation), as long as rates go down, that negative real yield helps gold.

Silver is an even stranger cat since it responds best to dollar weakness and, boy, do we have plenty of that…

Why are we focusing on pain, though, if vaccines are approved and if the beginning of the end for this unique period is ahead of us? Well, the price that most small businesses paid to indirectly help, by supposedly slowing the spread of the virus to the people at risk of dying of Covid-19 has been huge.

One day you woke up and the government told you that your baby – your source of income, your pride and joy, the business you took time, effort, thought, sweat, and sacrifice to bring to the marketplace – had to remain closed.

Small businesses received minimal assistance and we’ll only learn just how horrible the situation is in 2021.

This is because the dust will settle, restrictions will ease and we’ll see who is left standing.

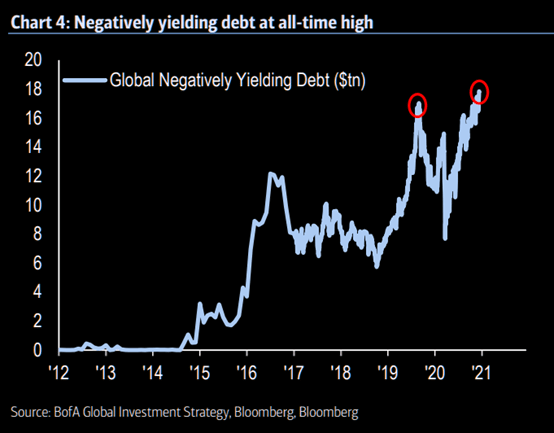

Courtesy: Zerohedge.com

Bond investors, as you can see, bet on technology advancements and on disinflation. No one buys a negative-yielding bond for the income, of course. The only way to profit from this – and there’s a large incentive to capture gains – is to sell the bond for more than you paid for it.

Appreciation occurs when yields fall. The price of the underlying asset (the bond) shoots up.

Obviously, QE does not create inflation, as was previously assumed, since we’ve had over a decade of it and the FED keeps missing its target. The FED has little control over inflation, but we, the people, do.

What are the implications of so many Americans in this poverty-stricken position?

- With 36% of voters believing in fraud and with roughly 80% of Republicans believing foul play, any hardship will serve as a catalyst for more division.

- Government will play an even bigger role in the lives of most Americans, who stand to become even more dependent upon it.

It’s time to address this issue, once and for all.

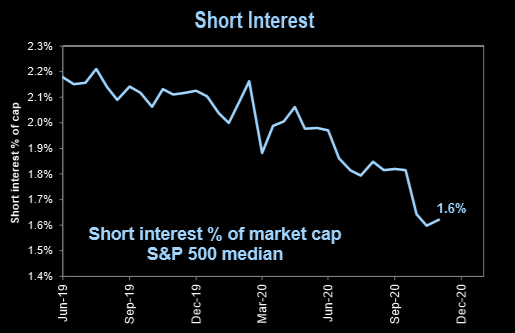

Courtesy: Zerohedge.com

We do not see how the unsustainable bullish stance in the stock market, coupled with the genuine distress of most Americans, continues to remain decoupled for another year.

The fundamental problems in the U.S. economy are bigger than what a central bank can address and, frankly, they’re not only more serious than what the government has to offer to “solve” them, but they’re being addressed with all of the wrong tools.

Nanny state capitalism is not a plan; Americans need to be inspired to get up and figure it out!

Pain cometh in 2021.

I am confused by this article.

Put forth some statistics and tell us we are screwed, then say we the people need to do something???

I believe my opinion get more to the heart of the fundamental issue:

We have 1/4 of our citizens as communist

We have 1/4 of our citizens as arrogantly beyond stupid

We have 1/2 of our Government as One World Order dopes

We Have a Media that is the enemy of the people.

The 1/2 of the population that are hard working Americans are

. to step out of line – The men have become metrosexuals

Until some real men and real leadership step up and FORCE multi issues we face we will continue to go down. In short 1/2 the country is not willing to do the nasty things the left does.

As I like to say: It’s like a football game where one team follows the rules precisely and the other team has no rules. Which one do you think would win? Our society is eating itself and the majority have become so stupid, and dependent on their nanny government, they can do nothing to even save themselves, much less their own society. “Turn out the lights, the party’s over”…….

If there is any one principle dearer and more sacred than all others in free governments, it is that which asserts the exclusive right of a free people to form and adopt their own fundamental law, and to manage and regulate their own internal affairs and domestic institutions.

Stephen A. Douglas

Amazon provides interesting tools, they probably did not think out long term, and will eventually be removed. But for now, it’s impossible for previous amazon purchases to be deleted or removed from your account, except to cancel your entire account permanently. So most people whom ever shopped there, still have those previous shopping records in online data. You can simply compare the then vs now pricing. Just about everything has shot up 20%, and many products over 2x price rises lately. Hyper inflation, regular inflation, on target with the fed, over the cpi, it does not matter. It’s here, it’s real.

I watched an interesting old movie the other day. “Mr Mom” with Michael Keaton. There was a scene where the corporate dude was announcing live on air, how their price of tuna would move slightly, but would come back down soon. Or something to that regard. The point being, it used to be a common consumer perception, that pricing should remain relatively stable, year over year. It’s not that way anymore and people have become entirely too comfortable with rising prices, while simultaneously the pace of earnings increase does not keep pace with rising pricing. In simple terms, we’re all losing a substantial amount of purchasing power year over year.

The safety net and padding room of being able to save is now over. You can’t save anymore, not with traditional savings. We’ve been hedge purchasing and have like razors and toilet paper to the moon. We’ll always need them, they don’t expire, they stay good on the shelf, and those products continue to increase in price. I’ve still got razors on the shelf I purchased half the price of today. Hedge purchasing is like saving, because you have lower overhead in the future. Same for big ticket items, get them now because tomorrow they will be more expensive. Not to mention if this china war happens to move beyond asymetric warfare in the digital and political world. You’ll wish you’d bought this or that item because if the global supply chains slip even further, you’ll be trying to build something at home.

Sometimes zero hedge drives me crazy. They know so much about finances and advanced investment utility. But on the other hand, they’re myopic due to their own success with investments. For the regular dude not so financially sophisticated, we’re just trying to save a buck and still get ahead somehow. If this was a board game, we’d all be holding our breath if the bank foreclosure of housing wave happens or not. That’s the whole enchilada which will be a decisive factor. Which is worse, negative lending rates or a second reo wave?

Universal Income is here. Deal with it. Reject it on principal. But still continue to take the money. The trick is to spend it faster and wiser than the next guy. We enjoy thrift and second hand too, because we get a lot of better quality made in usa products for literally pennies on the dollar, sometimes brand new. The best part of thrift and barter is you do not feed your cash back to the first receivers of money, and therefore are doing your part to stop such massive wealth redistribution to privileged corporations, aka; corporate welfare recipients and fed money first receivers. Focus on durability not disposable if you can, buy things that last.

YA… PAIN FOR THE COMMIE RATS! Get ready for the biggest shitshow ever. War on every front. Sucks that it is in winter but oh well. The tree of liberty will have plenty of water. Thank God I’m not in some blue state or big city and most everyone is armed. Our governor is a ccp turd but no one obeys him anyway and the sheriffs said they won’t enforce his mandate shit. All kinds of people shopping without masks and Trump flags everywhere. The time is here folks….

We have had horrible inflation since 2008, contrary to what the author contends. The stock market, bond market, real estate, higher education, and the medical complex have all experienced the massive inflation that everyone denies has occurred. Because none of these markets are included in the “official” inflation rate, everyone turns a blind eye. But it is there for all to readily see.

Hyperinflation is not garden variety inflation. Hyperinflation occurs when people distrust the currency and hurry to exchange it for real assets: land, food, weapons, precious metals, and other hard goods. When there are too many dollars in the system, they quickly become worthless. And we are fast approaching that point. We are already no better than a third-world banana republic, as shown by the recent election travesty… Weimer Amerika, here we come.