This article was contributed by Portfolio Wealth Global.

In the past year, I’ve noticed a dramatic change in the value of reliable news sources and of educational information. It is making me incredibly optimistic about America’s economic prospects in the immediate future and going into the Biden presidency.

Information about financials and about the economy are both spreading like wildfire and I believe this is creating one of the most financially-sound generations we’ve ever seen. They don’t blindly trust CNBC or CNN and they don’t get their financial content from mainstream media outlets. They might only be in their formative years, but I can already sense that they’re able to process information and to follow reason and logic.

The way financial content is disseminated on the alternative media is much more factual and far more aligned with the interests of the truth and of the audience itself, not of the owners of the channel or of the advertisers. Where corporate media relies on ratings, which bring ad revenue, the new world of content is much more competitive, with thousands of would-be experts who are fighting for your attention and they can only get it and retain it by providing massive value.

In the corporate media world, the barrier of entry is immense. One must spend millions of dollars to build a state-of-the-art studio, in order to enter the TV game, but with your webcam, a decent microphone, and basic background, you’re part of the financial blog industry.

The point is that we believe that through their newly-found content outlets, they will be exposed to information that will eventually turn them into better, more educated investors and citizens.

The one prediction I can give you is that we believe millions of millennials will soon come to think that a 30-yr mortgage at today’s fixed rates is exactly what they need to be considering and the mortgage industry will revive itself.

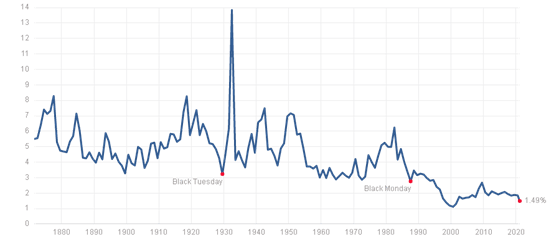

Courtesy: Multipl.com

As you can see, the S&P 500’s dividend yield is now noticeably below the yield of the 10-yr Treasury bond and that will help to change the behavior of investors.

The importance of dividends will be made clear and we believe more will become aware of the Dividend Aristocrat group of companies.

Secondly, companies that are expensive (like very expensive) might not enjoy the wild surges in prices that we witnessed in the past year. Instead, we believe they’ll slowly sell-off or stagnate.

Still, the fear that the economy is really overheating is real. It is part of the reason that tech stocks are sold-off and investors are rotating towards value. It is part of the reason Bitcoin is at all-time highs and that people are willing to pay record prices for Pokémon cards and vintage Ferraris.

Investors’ behavior is signaling they want to distance themselves from cash at all costs.

I have to say, though, that cash can be useful for investors if the next 2-3 months are how I believe they will be, which is painful and confusing with plenty of downside volatility.

Secondly, cash beats stocks and bonds about 28% of the time!

Don’t forget that, because it’s true and we must remember that paying any price for a security isn’t better than holding cash, which is what most investors believe.

I have actually raised my cash levels as of late and plan on keeping them high until I see better how this market handles 2.00% yields on the 10-yr bond.

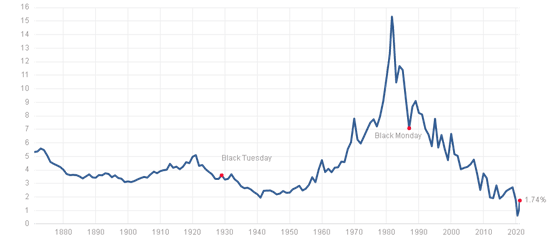

Courtesy: Multipl.com

Historically, yields that better fit the natural growth of the economy, which we calculate to be between 2.5% and 3%, will actually result in superior overall returns!

The market will learn to embrace normal rates, not fear them.

Because the inflation-scare includes the threat of rate hikes, gold has been slammed by the deserters, who were willing to accept even $1,690 for it. We believe that was a low and that it might yet be tested again in April or May, but that after that, the rally back to $2,000 and higher will be gorgeous!

The issue that I see with information such as this, is the actual subject matter itself.

The economic dynamics in play here present an entirely different paradigm. Namely in regards to the medium of exchange.

Our socio-economic baseline revolves around the Dollar. Not gold. People are in the constant struggle looking for this or that stock, or whatever, that gives the greatest ROI.

The point being, the Dollar is gasping its final feeble breaths of life. It’s on the way out. Falling prey to the consequences suffered by all fiat currencies.

You simply cannot ignore the laws of physics. What goes up, must come down, and the farther it rises, the harder the impact when it hits bottom.

We learned, and quickly forgot, that lesson back in 2008 when a lot of IRA’s and 401-K’s were rendered defunct and Trillions were spent propping up what should have been allowed to fall.

All these people hawking their secret insights, trying to sell their book, whatever. And all the sheep flocking to it like moths to the light.

Trying to hold on to a dead dream. A dream based on a medium of exchange that has ran its course.

A foolish act at best. The two largest holders of US currency are Russia and China. The two economies making moves to supplant the Dollar as the Reserve.

Who is Biden working overtime to piss off? Yep. Russia and China.

Add onto this the Trillions upon Trillions of Dollars they keep trying to pile on the heap to keep us afloat for just another quarter.

Now imagine what will happen when Russia and China decide to dump their Dollar holdings into the already massively inflated currency market for pennies on the dollar.

How will all the stock and bond market investments in the world stop that massive tsunami of economic destruction?