This article was originally published by Tyler Durden at ZeroHedge.

At a time when the Fed is already monetizing the entire US budget deficit thanks to helicopter money, sparking conversations about the utility of taxation, and when a Biden administration is set to at least try and roll back most of the Trump tax cuts, the last thing the population wants to hear about is even more taxes.

Yet in a “modest proposal” from Deutsche Bank, the bank argues that in a time of pervasive covid shutdowns, “those who can work from home (WFH) receive direct and indirect financial benefits and they should be taxed in order to smooth the transition process for those who have been suddenly displaced.”

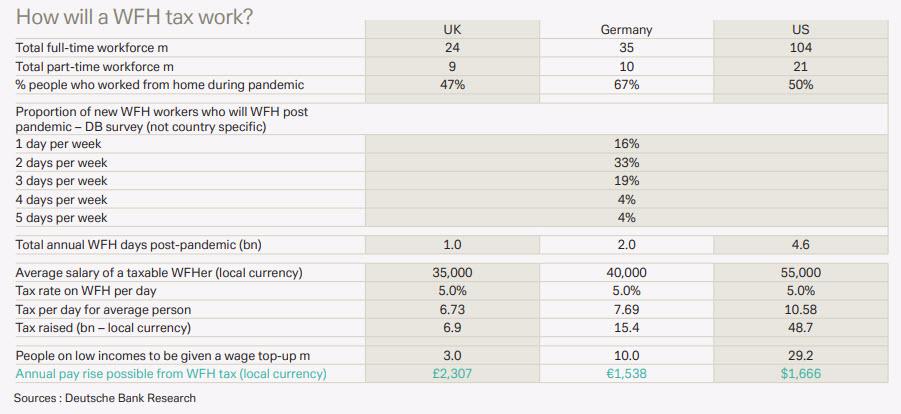

In other words, the argument goes that working from an office is somehow punitive, and since WFH during the pandemic leads to “many benefits” as a resulting “disconnecting themselves from face-to-face society” a 5% tax for each WFH day “would leave the average person no worse off than if they worked in the office.” The bank calculates that such a tax could raise $49bn per year in the US, €20bn in Germany, and £7bn in the UK. “That can fund subsidies for the lowest-paid workers who usually cannot work from home.”

In the report written by DB strategist Like Tumpleman, he argues that the popularity of WFH was growing even before the pandemic: “between 2005 and 2018, internet technology fuelled a 173 percent increase in the number of Americans who regularly worked from home. It is true that the overall proportion of people working from home before the pandemic was still small, at 5.4 percent based on census data, but the growth was still way ahead of the growth in the overall workforce.”

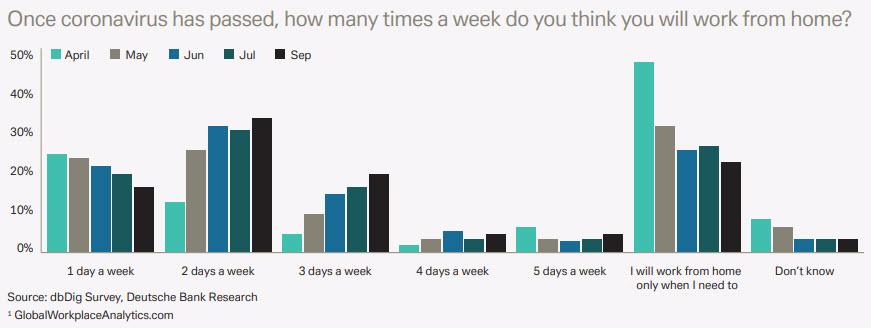

Naturally, the covid shutdowns have turbocharged that growth, and as a result the proportion of Americans who worked from home increased ten-fold to 56% during the pandemic. Many of these people will continue to work remotely for some time. Indeed, two-thirds of organizations say that at least three-quarters of their staff can work from home effectively, according to S&P Global Markets. Meanwhile, a DB survey shows that, after the pandemic has passed, more than half of people who tried out WFH want to continue it permanently for between two and three days a week.

This sudden shift to WFH means that, for the first time in history, “a big chunk of people have disconnected themselves from the face-to-face world yet are still leading a full economic life” as if that is somehow a bad thing.

It gets crazier: the bank claims that working in the comfort of one’s own home leads to a slew of financial benefits including:

- financial savings on expenses such as travel, lunch, clothes, and cleaning.

- indirect savings via forgone socializing and other expenses that would have been incurred had a worker been in the office.

- intangible benefits of working from home, such as greater job security, convenience, and flexibility.

- There is also the benefit of additional safety.

As if it is difficult to find someone who also sits in front of a computer all day long in Bangladesh and has the exact same skillset but would work for a fraction of the pay.

Yet those people who are working remotely are, according to DB, the equivalent of social parasites as they “contribute less to the infrastructure of the economy whilst still receiving its benefits” potentially extending the slump in national growth. In other words, the mere act of working from home makes you guilty of not propping up the economy!

That, according to Templeman “is a big problem for the economy as it has taken decades and centuries to build up the wider business and economic infrastructure that supports face-to-face working. If a great swathe of assets lie redundant, the economic malaise will be extended.”

In short, those who failed to develop the appropriate skill set and are “forced” to work in society – mostly employees of service companies – and who were unable to refuse to educate and train themselves to be able to “enjoy” the benefits of work from home jobs which incidentally include sitting in front of a computer for hours on end and in some notable cases masturbating in front of a zoom conference call, have to be rewarded monetarily by all those who are lucky enough to not have to work in public.

While it would be easy to laugh and merely brush this idea off as another ridiculous policy proposal from a bank whose very existence would be very much in question had it not been for several rounds of generous taxpayer-funded bailouts, since this is yet another grossly socialist proposal we are concerned it has a very high probability of passage not only in Europe but also in the US, especially if Democrats manage to pull of a “Blue wave” sweep in Georgia in January.

So far a WFH tax has merely been floated by a handful of Wall Street strategists; however once this idea gets more popular coverage, expect a groundswell of support for the idea which will promptly lead to yet another tax.

Below we republish the Deutsche Bank note in its entirety because it is clearly a blueprint for what’s to come:

A work-from-home tax, by Luke Templeman

For years we have needed a tax on remote workers – covid has just made it obvious. Quite simply, our economic system is not set up to cope with people who can disconnect themselves from face-to-face society. Those who can WFH receive direct and indirect financial benefits and they should be taxed in order to smooth the transition process for those who have been suddenly displaced.

The popularity of WFH was growing even before the pandemic. Between 2005 and 2018, internet technology fuelled a 173 percent increase in the number of Americans who regularly worked from home1. It is true that the overall proportion of people working from home before the pandemic was still small, at 5.4 percent based on census data, but the growth was still way ahead of the growth in the overall workforce.

Covid has turbocharged that growth. During the pandemic, the proportion of Americans who worked from home increased ten-fold to 56 percent. In the UK, there was a seven-fold increase to 47 percent. Many of these people will continue to work remotely for some time. Indeed, two-thirds of organizations say that at least three-quarters of their staff can work from home effectively, according to S&P Global Markets. Meanwhile, a DB survey shows that, after the pandemic has passed, more than half of people who tried out WFH want to continue it permanently for between two and three days a week

The sudden shift to WFH means that, for the first time in history, a big chunk of people have disconnected themselves from the face-to-face world yet are still leading a full economic life. That means remote workers are contributing less to the infrastructure of the economy whilst still receiving its benefits.

That is a big problem for the economy as it has taken decades and centuries to build up the wider business and economic infrastructure that supports face-to-face working. If a great swathe of assets lie redundant, the economic malaise will be extended.

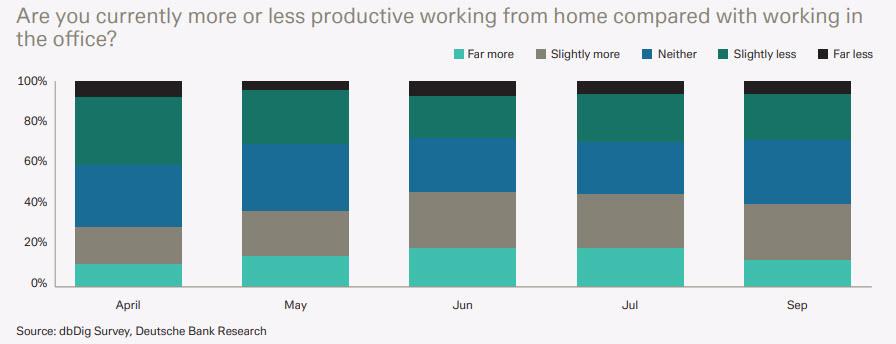

WFH is financially rewarding

WFH offers direct financial savings on expenses such as travel, lunch, clothes, and cleaning. Add to these the indirect savings via forgone socializing and other expenses that would have been incurred had a worker been in the office. Then there are the intangible benefits of working from homes, such as greater job security, convenience, and flexibility. There is also the benefit of additional safety. The newly-discovered gains of home working, both tangible and intangible, all have value. And they generally outweigh the costs. The latter have mostly come in the form of additional mental stress of juggling work and children and dealing with an imperfect home-office setup. These costs should not be underestimated, however, they usually pale in comparison with the gains. Hence why the vast majority of homeworkers want to continue remote working, on at least a part-time basis, after the pandemic passes.

First, the tax will only apply outside the times when the government advises people to work from home (of course, the self-employed and those on low incomes can be excluded). The tax itself will be paid by the employer if it does not provide a worker with a permanent desk. If it does, and the staff member chooses to work from home, the employee will pay the tax out of their salary for each day they work from home. This can be audited by coordinating with company travel and technology systems.

The tax rate? Those who can work from home tend to have higher-than-average incomes. If we assume the average salary of a person who chooses to work from home in the US is $55,000, a tax of five percent works out to just over $10 per working day. That is roughly the amount an office worker might spend on commuting, lunch, and laundry, etc. A tax at this rate, then, will leave them no worse off than if they had chosen to go into the office. If we apply the same tax rate to workers in the UK with an assumed average WFH salary of £35,000, it works out to just under £7 per day. In Germany, a WFH salary of €40,000 leads to a tax of just over €7.50 per day.

A tax at this level means that neither companies nor individuals will be worse off. In fact, companies may be far better off as the savings from downsizing their office will more than makeup for the cost of the WFH tax they will incur.

How much will the tax raise?

First the US. Of the 104m Americans who work full time, half worked from home during the pandemic. That is up from the 5.4 percent who already worked from home before the pandemic. Of that additional 45 percent, our survey shows that three quarters want to work from home to some degree post-covid with 16 percent wanting one day a week, 33 percent two days, 19 percent three days, 4 percent four days, and 4 percent five days.

Adding this up, there could be 4.2bn new days every year being worked from home post covid. With an additional 394m days for those part-time and full-time staff who already work from home and are not self-employed, that gives 4.6bn WFH days per year. At an average salary of $55,000 and a tax rate of five percent, the WFH tax will raise $48bn per year. The same calculation in the UK and Germany (using country-specific WFH data and the salary levels assumed above) yields a tax take of £6.9bn and €15.9bn respectively.

What can the government do with this money?

In the US, the $48bn raised could pay for a $1,500 grant to the 29m workers who cannot work from home and earn under $30,000 a year (excluding those who earn tips). Many of these people are those who assumed the health risks of working during the pandemic and are far more ‘essential’ than their wage level suggests.

Similarly, in Germany, the €15.9bn raised could fund a €1,500 grant to the bottom 12 percent of people in the country who have a standard of living equivalent to €12,600 (after adjusting for the size of their household). Similarly in the UK, the £6.9bn raised could provide a grant of £2,000 to 12 percent of those aged over 25 who work for the minimum wage. Of course, the exact amount of the grant could be based on an asymmetric tapering system.

Some will argue against the tax. They will say that engagement with the economy is a personal choice and they should not be penalized for making that decision. Yet, these people should remember that governments have always backsolved taxes to suit the social environment. Consider that in centuries past, when it was socially unpalatable in the UK to introduce an income tax, the government implemented a window tax. As society changed, the window tax was abolished and, eventually, an income tax was introduced. In the same way, as our current society moves towards a state of ‘human disconnection’, our tax system must move with it.

Best of all, a WFH tax does not merely subsidize businesses that have no long-term future. If, for example, a city-center sandwich shop is no longer needed, it does not make sense for the government to support the business in the medium term. But it does make sense to support the mass of people who have been suddenly displaced by forces outside their control. Many will have to take low-paid jobs while they retrain or figure out their next step in life. From a personal and economic point of view, it makes sense that these people should be given a helping hand. It also makes sense to recognize that essential workers assume the covid risk for low wages. Those who are lucky enough to be in a position to ‘disconnect’ themselves from the face-to-face economy owe it to them.

Then apparently everyone agrees with me. America sucks because of Americans, and it sucks so much that nobody wants to be a part of it.

I would prefer to tax the people that voted 5%, but that would be a poll tax which is illegal, and I would not be asking for it if the candidates were not guilty of vio,ating constitutional rights as their policies.

I was one of the 93 million Americans that did not vote in this election. Which ever candidate is determined the victor, their voters will be vastly out numbered by the silent majority.

Trump would be the first candidate to win a second term with not only an economic recession, but the worst economic condidtions in history with mandated lock downs. It is a situtation of polar opposites as well, with Biden being the worst challenger in history, senile, repeated corruption and collusion

charges, and sex offender charges. So, if people wish to work from home in order to avoid people that voted for either of those candidates, and the psychos that are peddling covid scientific fraud, I understand.

Society is toxic. Safer at home!

Andrea Iravani

When your representatives fraternize and dance with all kinds of Rainbow Confederates, there can be no clearer sign that family friendly working conditions will not be part of the social contract. I spit upon the claim that they are traditional and conservative, who democide the majority demographic.

You require a live human, with breath and a pulse, at the labor post, yet do not cover the cost of life support, free and clear and without encumberments. I have left a couple of job interviews, in the middle. What power do these people hold over you?

I worked for these parasites for nine years, and enabled work-from-home by deploying the technology, so let me chime in here.

THEY benefit from those who work from home by not having to pay for and maintain office space, provide electricity, telecomunications, supplies, break-rooms, cafeterias, etc.

Do they help their work from home employees pay for their internet service? No. Do they pay the portion of electicity used by work from home employees while working for the firm? No. Do they compensate the employee for having to dedicate a portion of their living space to work? No. DB and all these corporate parasites should either be forced to offset these expenses shifted to the employee with a credit, or they should be taxed for the avoided costs of doing business. A 5% tax hike for DB for each work from home emplyee sounds much more equitable.

So the AIC (A**holes In Charge) want to penalize (TAX) those folks that found a way to remain productive & obey all the draconian rules stuffed down everyone’s throat. Look for more tyranny if Biden / Harris are successful in the theft of the Presidential Election.

I have “Breaking News” for the brain-dead news readers that continue to use the phrase “President-Elect-Biden”. For those that remember their college days – journalism-majors tended to NOT be the brightest bulbs on the tree.

WFH is just a small part of the plan.

Robotics and A.I will now take the place of many ENDANGERED slaves that don’t have the option of working from home.

been watching Ayn Rand interviews with Mike Wallace , Johnny Carson

I missed something really important the first time.

READ, WEEP, PRINT AND KEEP!

This should be on the front page of every newspaper.

Charley Reese’s Final column!

A very interesting column. COMPLETELY NEUTRAL.

Be sure to Read the Poem at the end..

Charley Reese’s final column for the Orlando Sentinel… He has been a journalist for 49 years. He is retiring and this is HIS LAST COLUMN.

Be sure to read the Tax List at the end.

This is about as clear and easy to understand as it can be. The article below is completely neutral, neither anti-republican or democrat. Charlie Reese, a retired reporter for the Orlando Sentinel, has hit the nail directly on the head, defining clearly who it is that in the final analysis must assume responsibility for the judgments made that impact each one of us every day. It’s a short but good read. Worth the time. Worth remembering!

545 vs. 300,000,000 People

-By Charlie Reese

Politicians are the only people in the world who create problems and then campaign against them.

Have you ever wondered, if both the Democrats and the Republicans are against deficits, WHY do we have deficits?

Have you ever wondered, if all the politicians are against inflation and high taxes, WHY do we have inflation and high taxes?

You and I don’t propose a federal budget. The President does.

You and I don’t have the Constitutional authority to vote on appropriations. The House of Representatives does.

You and I don’t write the tax code, Congress does.

You and I don’t set fiscal policy, Congress does.

You and I don’t control monetary policy, the Federal Reserve Bank does.

One hundred senators, 435 congressmen, one President, and nine Supreme Court justices equates to 545 human beings out of the 300 million are directly, legally, morally, and individually responsible for the domestic problems that plague this country.

I excluded the members of the Federal Reserve Board because that problem was created by the Congress. In 1913, Congress delegated its Constitutional duty to provide a sound currency to a federally chartered, but private, central bank.

I excluded all the special interests and lobbyists for a sound reason. They have no legal authority. They have no ability to coerce a senator, a congressman, or a President to do one cotton-picking thing. I don’t care if they offer a politician $1 million dollars in cash. The politician has the power to accept or reject it. No matter what the lobbyist promises, it is the legislator’s responsibility to determine how he votes.

Those 545 human beings spend much of their energy convincing you that what they did is not their fault. They cooperate in this common con regardless of party.

What separates a politician from a normal human being is an excessive amount of gall. No normal human being would have the gall of a Speaker, who stood up and criticized the President for creating deficits.. ( The President can only propose a budget. He cannot force the Congress to accept it.)

The Constitution, which is the supreme law of the land, gives sole responsibility to the House of Representatives for originating and approving appropriations and taxes. Who is the speaker of the House?( John Boehner. He is the leader of the majority party. He and fellow House members, not the President, can approve any budget they want. ) If the President vetoes it, they can pass it over his veto if they agree to. [The House has passed a budget but the Senate has not approved a budget in over three years. The President’s proposed budgets have gotten almost unanimous rejections in the Senate in that time. ]

It seems inconceivable to me that a nation of 300 million cannot replace 545 people who stand convicted — by present facts — of incompetence and irresponsibility. I can’t think of a single domestic problem that is not traceable directly to those 545 people. When you fully grasp the plain truth that 545 people exercise the power of the federal government, then it must follow that what exists is what they want to exist.

If the tax code is unfair, it’s because they want it unfair.

If the budget is in the red, it’s because they want it in the red.

If the Army & Marines are in Iraq and Afghanistan it’s because they want them in Iraq and Afghanistan ..

If they do not receive social security but are on an elite retirement plan not available to the people, it’s because they want it that way.

There are no insoluble government problems.

Do not let these 545 people shift the blame to bureaucrats, whom they hire and whose jobs they can abolish; to lobbyists, whose gifts and advice they can reject; to regulators, to whom they give the power to regulate and from whom they can take this power.

Above all, do not let them con you into the belief that there exists disembodied mystical forces like “the economy,” “inflation,” or “politics” that prevent them from doing what they take an oath to do.

Those 545 people, and they alone, are responsible. They, and they alone, have the power.

They, and they alone, should be held accountable by the people who are their bosses. Provided the voters have the gumption to manage their own employees… We should vote all of them out of office and clean up their mess!

Charlie Reese is a former columnist of the Orlando Sentinel Newspaper.

What you do with this article now that you have read it… is up to you.

This might be funny if it weren’t so true.

Be sure to read all the way to the end:

Tax his land,

Tax his bed,

Tax the table,

At which he’s fed.

Tax his tractor,

Tax his mule,

Teach him taxes

Are the rule.

Tax his work,

Tax his pay,

He works for

peanuts anyway!

Tax his cow,

Tax his goat,

Tax his pants,

Tax his coat.

Tax his ties,

Tax his shirt,

Tax his work,

Tax his dirt.

Tax his tobacco,

Tax his drink,

Tax him if he

Tries to think.

Tax his cigars,

Tax his beers,

If he cries

Tax his tears.

Tax his car,

Tax his gas,

Find other ways

To tax his ass.

Tax all he has

Then let him know

That you won’t be done

Till he has no dough.

When he screams and hollers;

Then tax him some more,

Tax him till

He’s good and sore.

Then tax his coffin,

Tax his grave,

Tax the sod in

Which he’s laid…

Put these words

Upon his tomb,

‘Taxes drove me

to my doom…’

When he’s gone,

Do not relax,

Its time to apply

The inheritance tax.

Accounts Receivable Tax

Building Permit Tax

CDL license Tax

Cigarette Tax

Corporate Income Tax

Dog License Tax

Excise Taxes

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Fuel Permit Tax

Gasoline Tax (currently 44.75 cents per gallon)

Gross Receipts Tax

Hunting License Tax

Inheritance Tax

Inventory Tax

IRS Interest Charges IRS Penalties (tax on top of tax)

Liquor Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Personal Property Tax

Property Tax

Real Estate Tax

Service Charge Tax

Social Security Tax

Road Usage Tax

Recreational Vehicle Tax

Sales Tax

School Tax

State Income Tax

State Unemployment Tax (SUTA)

Telephone Federal Excise Tax

Telephone Federal Universal Service Fee Tax

Telephone Federal, State and Local Surcharge Taxes

Telephone Minimum Usage Surcharge Tax

Telephone Recurring and Nonrecurring Charges Tax

Telephone State and Local Tax

Telephone Usage Charge Tax

Utility Taxes

Vehicle License Registration Tax

Vehicle Sales Tax

Watercraft Registration Tax

Well Permit Tax

Workers Compensation Tax

STILL THINK THIS IS FUNNY?

Not one of these taxes existed 100 years ago, & our nation was the most prosperous in the world. We had absolutely no national debt, had the largest middle class in the world, and Mom stayed home to raise the kids.

What in the heck happened? Can you spell ‘politicians?’

I hope this goes around THE USA at least 545 times!!! YOU can help it get there!!!

GO AHEAD. . . BE AN AMERICAN!!!

SEND THIS TO EVERYONE YOU KNOW

History Repeats…

Ecclesiastes 1:9-10

9 That which has been is that which will be,

And that which has been done is that which will be done.

So there is nothing new under the sun.

10 Is there anything of which one might say,

“See this, it is new”?

Already it has existed for ages

Which were before us.

Freedom to Chains a radio broadcast from 1965 by Paul Harvey, a word of prophesy for today.https://www.youtube.com/watch?v=n0FF13u13WE&t=70s